Page 12 - CII Artha Magazine 2022

P. 12

Domestic Trends

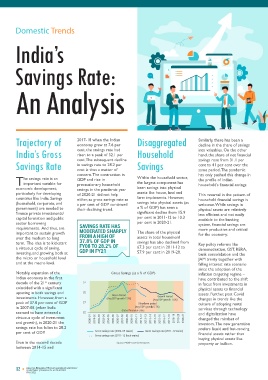

India’s Proportional Share of Household of Savings Components (%) and pension funds. Rising retail “International experi-

participation in the markets is

ence, especially from

another encouraging sign.

high-growth East Asian

1.9

1.9

1.7

1.6

1.6

1.4

1.6

Savings Rate: 100.0 67.3 65.5 62.0 62.0 53.2 57.2 59.0 60.1 57.9 46.7 Conclusion economies, suggests that

1.1

1.1

0.9

such growth can only be

80.0

sustained by a ‘virtuous

60.0

cycle’ of savings, invest-

India has grown fastest when

An Analysis 20.0 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21 its economy has entered the ment and exports

40.0

52.5

catalysed and supported

virtuous cycle of savings and

44.9

39.6

41.0

41.1

38.8

36.1

36.4

32.8

31.1

investment. The periods of

by a favourable demo-

0.0

falling savings and investment,

graphic phase,”

and corresponding

Net financial saving

Physical assets

have not yielded similar

Source: MOSPI and CII Research Valuables consumption driven growth Economic Survey 2018-19

results in terms of growth as Going forward, structural

is evident from the below transformation away from

financial savings. Share of graph. agriculture, rising urbanisa-

Trajectory of 2017-18 when the Indian Disaggregated Similarly, there has been a The rise of Gross household Investments into small Decline in domestic tion, digitalisation, invest-

ment education and a large

savings etc. has risen too.

financial savings is a positive

1

economy grew at 7.6 per

decline in the share of savings

household savings rate has

India’s Gross cent, the savings rate had Household into valuables. On the other sign, showing increasing This is promising as it come through falling savings working age population

preferring fast moving assets,

provides more funds to the

financialization of the

risen to a peak of 32.1 per

hand, the share of net financial

particularly into physical

are expected to further

government to finance its

economy. However, it is

Savings Rate cent. The subsequent decline Savings savings rose from 31.1 per important to look at each of fiscal deficit. assets. This has been driven by push up savings rate. Further,

in savings rate to 28.2 per

cent to 41 per cent over the

falling growth in disposable

there is a need to push for

these components to

cent is thus a matter of

same period. The pandemic

incomes, increased bank

financialization and diversifi-

Further, provident and

T he savings rate is an concern. The contraction in Within the household sector, has only pushed this change in understand the exact place pension funds’ share have borrowings & running down cation of household savings

where funds are going/are

GDP and rise in

the profile of Indian

of savings to meet existential

into rural India. Support to

the largest component has

risen. This has been driven by

being saved.

important variable for

precautionary household

economic development, savings in the pandemic year been savings into physical household’s financial savings. government’s measures to and consumption needs. MSMEs reeling under the

particularly for developing of 2020-21 did not help assets like house, land and This reversal in the pattern of The below graph represents enhance pension coverage However, a fall in share of impact of the pandemic, is

countries like India. Savings either, as gross savings rate as farm implements. However, household financial savings is the share of various financial like opening of NPS savings into valuables like gold essential to bring up savings

(household, corporate, and a per cent of GDP continued savings into physical assets (as welcome. While savings in instruments in Indian (National Pension Scheme) and silver, and a rise in in both physical and financial

government) are needed to their declining trend. a % of GDP) has seen a physical assets are relatively household’s portfolio. It is to general public, as well as financial savings represents a assets. To achieve the

finance private investments/ significant decline from 15.9 less efficient and not easily evident that the Indian the introduction of the Atal positive trend towards ambitious 2047 Vision, the

capital formation and public per cent in 2011-12 to 10.3 available to the banking household has been Pension Yojana for the financialization of the Indian elephant must start

sector borrowing per cent in 2020-21. system, financial savings are diversifying its portfolio away unorganised sector. However, economy and diversification of running now and the

requirements. And thus, are SAVINGS RATE HAS more productive and critical from low yielding bank the share of life insurance Indian household’s financial domestic savings can be its

important to sustain growth MODERATED SHARPLY The share of the physical for the economy. deposits to other financial funds has declined before portfolio into more mahout which puts India

over the medium to long FROM A HIGH OF assets in total household instruments. There has been a rising marginally in the Covid productive assets. This trend into the virtuous cycle of

term. The idea is to kickstart 37.8% OF GDP IN savings has also declined from Key policy reforms like growing interest in the share year. For a broad-based will help India generate funds savings, investment and

a virtuous cycle of saving, FY08 TO 28.2% OF 67.3 per cent in 2011-12 to demonetisation, GST, RERA, market as seen from the rise social security to its citizens, within the country to invest in growth.

investing, and growing, both at GDP IN FY21 57.9 per cent in 2019-20. bank consolidation and the in the share of equity and life insurance needs to be the economy.

the micro or household level JAM trinity together with mutual funds in household expanded just like provident

and at the macro level. falling interest rate scenario

since the adoption of the

Notably, expansion of the Gross Savings (as a % of GDP) inflation targeting regime –

Indian economy in the first have contributed to the shift Share of the Components of Total Gross Financial Savings (%) Savings/Investment vs Consumption Driven Growth

st

decade of the 21 century 37 in focus from investments in 55.0 62.0

coincided with a significant physical assets to financial 39.0

upswing in both savings and 32 assets. Further, post Covid 36.0 Growth Period 60.0

Boom Period

Boom Period

Growth Period

investments. However, from a (Avg GDP growth 7.9%) (Avg GDP growth 7.6%) changes in trends like the 35.0 (Avg GDP growth 7.9%) (Avg GDP growth 7.6%) 58.0

peak of 37.8 per cent of GDP 27 Slowdown period culture of adopting rental 33.0 Slowdown period

in 2007-08 (when India (Avg GDP growth 5.7%) services through technology 30.0 (Avg GDP growth 5.7%) 56.0

seemed to have entered a 22 Global financial crisis and digitalization have 15.0 27.0 Global financial crisis 54.0

virtuous cycle of investment 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21 changed the mindset of 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20

and growth), in 2020-21 the investors. The new generation -5.0 currency deposits equity mutual investment life provident and

in small

savings rate has fallen to 28.2 prefers liquid and fast-moving funds savings etc. insurance pension funds I/Y S/Y C/Y (rhs)

funds

per cent of GDP. Gross savings rate (2004-05 series) Gross savings rate (2011-12 series) financial assets rather than

Gross savings rate (2011-12 Back-series) -25.0 2011-12 2020-21 (3Q AVG)

buying physical assets like Note: I/Y is investment to output, S/Y is saving to output and

C/Y is consumption to output (on right hand side)

Even in the second decade Source: MOSPI and CII Research property or bullion. Note: 2020-21 data is the average of the first three quarters Source: MOSPI and CII Research

Source: RBI and CII Research

between 2014-15 and

1 Household financial savings refer to currency, bank deposits, equity, debt securities, mutual funds, provident & pension funds, insurance, and investments in small savings schemes.

The total of these savings is referred to as gross household financial savings.

12 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 13

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

MAY 2022 MAY 2022