Page 13 - CII ARTHA India’s Growth Prospects

P. 13

Domestic Trends

cent in 2022-23. as it is among the most Furthermore, as seen in the share in new project

Construction services, on the labour-intensive sectors. Investment graph below, private sector announcements from 65.0 per

other hand, is estimated to Financial, real estate, and Outlook has always had a higher share cent in Q2 FY24 to 87.6 per

spearhead growth with a professional services are in new project cent in Q3 FY24, while that of

double-digit surge of 10.7 per expected to maintain a strong announcements than the the government fell steeply

cent in 2023-24, supported by performance, projecting 8.9 Indian economy has proved to be resilient in the face government. The recent from high of 35.1 per cent in

a robust performance in the per cent growth compared to of external headwinds. Domestic demand is gathering Analysis quarter witnessed a sharp Q2 FY24 to 12.4 per cent in

first half of the year, The 7.1 per cent in 2022-23. strength, aided by lowering of inflation levels. Further, uptick in private sector’s Q3 FY24.

strong growth in construction Public administration and with government continuing to tread on the path of

augurs well for employment defence are also expected to fiscal consolidation with emphasis maintained on

perform well in 2023-24. spurring public capital expenditure, should provide an

additional buffer for growth. Private investment is

slowly but steadily improving too, with early signs of

Sectoral Growth Rate (y-o-y%) crowding in of private investment noticed, as indicated ew project

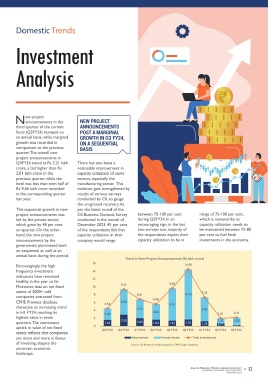

by the latest round of CII's Business Outlook Survey N announcements in the NEW PROJECT

Agiculture 1.8 4 for Q3 2023-24. third quarter of the current ANNOUNCEMENTS

Mining & Quarrying 4.6 8.1 fiscal (Q3FY24) slumped on POST A MARGINAL

Manufacturing 1.3 6.5 There are a few niggling concerns on the horizon an annual basis, while marginal GROWTH IN Q3 FY24,

Utility Services 8.3 9 which are worth mentioning. Headline inflation, growth was recorded in ON A SEQUENTIAL

comparison to the previous

Construction 10 10.7 though, has come off its recent high, remains above the quarter. The overall new BASIS

Trade, Hotels, Transport & Communication 14 RBI’s target of 4 per cent, pushed mainly by high food project announcements in

ndia’s real GDP is estimated While the real GDP is 6.3 inflation. In addition, there are also concerns about Q3FY24 stood at Rs 2.21 lakh There has also been a

8.9

to grow at an impressive estimated to record a Financial, Real Estate & Prof Services 7.1 weak consumption which has a lion share in overall crore, a tad higher than Rs noticeable improvement in

rate of 7.3 per cent in the marginal increase growth Public Administration & Defence 7.2 7.7 GDP, rural consumption which has been impacted by 2.01 lakh crore in the capacity utilization of some

fiscal year 2023-24 as per the compared to the previous erratic monsoon. That said, there are a few nascent previous quarter, while the sectors, especially the from CMIE, the new projects

first advance estimates of year, nominal GDP is 2022-23 2023-24 (FAE) signs of recovery, such as pick-up noted in two-wheel- level was less than even half of manufacturing sector. This announced under the sector

national income, slightly expected to slow down to 8.9 er sales and rural FMCG sales as per the Rs 9.66 lakh crore recorded evidence gets strengthened by mainly comprised of chemical

higher than the 7.2 per cent per cent growth in 2023-24 Note: FAE is First Advance Estimates in the corresponding quarter results of various surveys products, metal products and

recorded in the previous year. compared to the substantial Source: MoSPI recent data. last year. conducted by CII, to gauge transport equipment. Other

The first half of 2022-23 16.1 per cent seen in the the on-ground recovery. As sectors attracting higher level

witnessed robust economic previous year. This In conclusion, India's economic performance in The sequential growth in new per the latest round of the At the sectoral level, of new investments include

activity, boasting an average deceleration is attributed to a 2023-24 reflects resilience and growth across various project announcements was CII-Business Outlook Survey between 75-100 per cent range of 75-100 per cent, manufacturing sector, despite services (other than financial)

real GDP growth of 7.7 per sharp decrease in the GDP INVESTMENT Government frontloading of sectors, with challenges and uncertainties calling for led by the private sector, conducted in the month of during Q3FY24. In an which is noteworthy as weak external demand, and electricity. Within

cent. However, the second deflator which is estimated EMERGES AS A KEY capital expenditure has fuelled strategic measures to ensure sustained economic which grew by 48 per cent December 2023, 45 per cent encouraging sign, in the last capacity utilization needs to attracted higher investments services, transport services

half of 2023-24 is expected to increase by at 1.6 per cent in GROWTH CATALYST investment growth which recovery. on-quarter. On the other of the respondents felt that two surveys too, majority of be maintained between 75-80 in Q3FY24. As per the data did well.

experience a marginal 2023-24, significantly lower WHILE PRIVATE registered a healthy pace of hand, the new project capacity utilization in their the respondents expect their per cent to fuel fresh

decrease, projecting a growth than 8.9 per cent reported in CONSUMPTION TRAILS 9.1 per cent in H1 of 2023-24 announcements by the company would range capacity utilization to be in investments in the economy.

rate of 6.9 per cent. the previous year. and expected to increase government plummeted both

further to 11.1 per cent in on sequential as well as an

H2. States, too, have played a annual basis during the period.

On the demand side, supportive role in increasing Expenditure Components of GDP (y-o-y%) 16 Trend in New Project Announcements (Rs lakh crore)

investment remains a critical capex with a robust 52 per Encouragingly, the high 14.50

of favourable government driver of growth, with private cent surge in H1 of 2023-24 11.4 frequency investment 14

Overall, high GDP growth is policies, a significant consumption lagging behind. by 17 select states. 10.3 indicators have remained

expected to be contributed improvement from 1.3 per Private consumption, healthy in the year so far. 12

by non-agriculture sector, cent reported in the contributing 57 per cent to Exports have emerged as a 7.5 Moreover, data on net fixed 10 9.42 9.66

This remarkable growth The agriculture sector is especially the industry previous year. GDP, is expected to grow at big drag on growth, projecting assets of 2000+ odd

performance is underpinned experiencing a marked segment. Mining and quarrying only 4.4 per cent in 2023-24, a growth of only 1.4 per cent 4.4 4.1 companies extracted from 8 6.81 12.79 7.35

by robust performance of slowdown, estimated to grow is expected to do well with a The services sector, while trailing the 7.5 per cent in 2023-24 on the back of CMIE Prowess database 6 6.49 5.66

high-frequency indicators. at a meagre rate of 1.8 per growth rate of 8.1 per cent in displaying healthy growth, has recorded in the previous year weak external demand, a 0.1 showcase an increasing trend 4.56 8.24

Strong growth in GST and cent in 2023-24 compared to 2023-24 compared to 4.6 per moderated slightly compared due to weak rural demand sharp decline from the 13.6 in H1 FY24, reaching its 4 4.76 4.02 6.09 2.21

direct tax collections, 4 per cent in 2022-23. The cent in the previous year. to the previous year. Trade, resulting from subdued per cent growth in the PFCE GFCE GFCF highest value in seven 2.94 2.01

increased airline and train weak growth in the Utility services are also hotels, transport, and agriculture growth coupled previous year. Imports are quarters. The continuous 2 1.62 2.93 2.05 1.64 1.42 1.70 1.31 1.93

passenger traffic, credit agriculture is attributed to expected to record robust communication sector, in with high food inflation. also estimated to moderate in 2022-23 2023-24 (FAE) uptick in value of net fixed 0 1.26 0.71 0.27

expansion, manufacturing PMI erratic monsoon that dragged growth at 8.3 per cent along particular, exhibit notable Government consumption, 2023-24, recording a growth assets reflects that companies Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 Q4 FY23 Q1 FY24 Q2 FY24 Q3 FY24

growth and moderation in the down kharif production by with manufacturing sector moderation, with estimated however, is projected to grow of 13.2 per cent compared to Note: PFCE is Private Final Consumption Expenditure, GFCE is Government are more and more in favour Government Private Sector Total investments

Final Consumption Expenditure and GFCF is Gross Fixed Capital Formation

gross NPAs ratio, collectively 4.6 per cent from previous recording a steady 6.5 per growth of 6.3 per cent in at 4.1 per cent in 2023-24 17.1 per cent in 2022-23. Source: MoSPI of investing, despite the

bode well for high growth of fiscal and risks to rabi cent growth, supported by 2023-24 compared to 14 per compared to an anaemic 0.1 uncertain economic Source: CII Research analysis based on CMIE Capex database

the economy. production from low water lower input costs and a slew per cent in 2022-23. landscape.

reservoir levels.

12 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 13

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

FEBRUARY 2024 FEBRUARY 2024

according to Niti Aayog and are hesitant to under Article 6 of the Paris consider implementing a

RMI. The move encourages finance/refinance large-scale Agreement. It will help nationwide policy mandating

manufacturers and project green hydrogen projects. create a marketplace for the use of Green M15 fuel i.e.

developers to invest in green • The production cost of Indian green fuels like green mixing 15 per cent green

hydrogen and its derivatives various green fuel hydrogen and its methanol with petrol, in

like green ammonia and technologies, such as green derivatives, green methanol, transportation and other

methanol, putting India among hydrogen and its and SAF, among others, in applicable sectors, supported

those leading countries, such derivatives, is higher. the international market. by incentives for producers

as the United States and the However, grey hydrogen, • There’s a need for speeding and consumers to adopt this

European Union, which have alongside various grey up strategic interventions fuel. This could be a pivotal

allocated public funding for manufacturing methods, has for the Green Hydrogen step in India's journey

green hydrogen. towards a greener and more

historically benefited from Transition Program by

subsidies. Without a robust offering incentives for both sustainable future.

Establishing a market for green and liquid global carbon green hydrogen production • To ensure widespread

ammonia and methanol is a market, pricing the value of and electrolyser availability of Green M15 fuel,

global issue. In India, carbon and embedded manufacturing. These there’s a need for investment

forward-thinking standards by emissions in the production initiatives will catalyze in the necessary

the Bureau of Indian Standards, and usage of grey hydrogen industry growth. infrastructure for its

such as blending DME with becomes challenging. This is production, distribution, and

LPG and methanol with diesel, why, initially, green • The cost of renewable storage.

are significant steps towards hydrogen seems more energy can be further

integrating green fuels. reduced through energy • Campaigns should be

expensive than grey surplus banking provisions, launched to educate the

hydrogen.

especially for sectors public and other stakeholders

• The cost of funding remains mandated to use green about the benefits of using

a persistent bottleneck, hydrogen. Green M15 fuel and address

presenting a considerable • The government should misconceptions.

challenge for project implement targeted

developers, impacting the incentives to boost the By adopting these

optimization of capital export of green molecules. recommendations, India can

expenditure and project It will help establish India as make significant strides towards

execution. energy self-reliance,

a global leader in environmental sustainability, and

renewable energy.

Suggestions • A mechanism should be economic growth.

developed to facilitate Conclusion

Challenges To address the challenges, we low-cost financing and

provide benefits like

suggest that the government

take several steps to provide a accelerated depreciation This is the time to take

Despite government efforts much-needed boost to the for green hydrogen immediate action to overcome

to promote green hydrogen industry, such as: infrastructure investments. all the bottlenecks on the road

and its derivatives, the sector • The government should towards leading the global

is still in its infancy, and • As in the initial days of expand the FAME India transition to sustainable energy.

acknowledging and addressing renewable energy, the (Faster Adoption and With right policies in place and

the hurdles that impede our government mandated its Manufacturing of (Hybrid the development of a market for

full potential in this critical usage through Renewable &) Electric Vehicles in India) green methanol and ammonia,

sector is essential. Among the Purchase Obligation (RPO). Scheme to include green India can unlock the full

various challenges are - potential of green hydrogen and

Similarly, we suggest that a methanol vehicles in it. It its derivatives. Moreover, it will

• There isn’t much existing quota should be mandated will not only boost the provide a much-needed boost

demand and a developed for the use of green market but also provide for the production, distribution,

market ecosystem for hydrogen in sectors like support to the green and usage of green hydrogen and

green hydrogen and its fertilizers, chemicals, steel, hydrogen ecosystem in the its derivatives across sectors.

derivatives like green and power generation. country. Such initiatives will not only help

ammonia and methanol, not Creating demand through • There’s a need for funding India in achieving targeted

only in India but also policy will spur sectoral and support for research climate goals but also position it

globally, compared to other growth and reduce the and development in the as a leader in the green energy

conventional fuels. production cost of green areas of green hydrogen revolution.

hydrogen.

• Project developers face and methanol-based

difficulty in getting final • Leveraging its international technologies. It will further

offtake agreements signed. relations, the government help enhance efficiency and

should expedite the signing reduce costs.

• In the absence of advance

offtake contracts, lenders of bilateral agreements • The government should