Page 15 - CII ARTHA India’s Growth Prospects

P. 15

Furthermore, as seen in the share in new project Additionally, while new investments made by the value of completed projects at Most of the completed projects

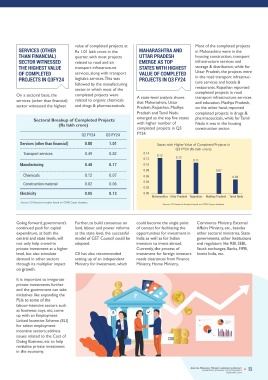

graph below, private sector announcements from 65.0 per project announcements are a government contracted both SERVICES (OTHER Rs 1.01 lakh crore in the MAHARASHTRA AND in Maharashtra were in the

has always had a higher share cent in Q2 FY24 to 87.6 per good barometer of business on a sequential and annual THAN FINANCIAL) quarter, with most projects UTTAR PRADESH housing construction, transport

in new project cent in Q3 FY24, while that of sentiments, the value of basis to stand at Rs 138.4 lakh SECTOR WITNESSED related to road and air EMERGE AS TOP infrastructure services and

announcements than the the government fell steeply ongoing investments is a crore, its share in the total THE HIGHEST VALUE transport infrastructure STATES WITH HIGHEST storage & distribution, while for

government. The recent from high of 35.1 per cent in better indicator for gauging ongoing investments OF COMPLETED services, along with transport VALUE OF COMPLETED Uttar Pradesh, the projects were

quarter witnessed a sharp Q2 FY24 to 12.4 per cent in the investments happening on remained high at around 56 PROJECTS IN Q3FY24 logistics services. This was PROJECTS IN Q3 FY24 in the road transport infrastruc-

uptick in private sector’s Q3 FY24. ground as it nets out the per cent. followed by the manufacturing ture services and hotels &

value of stalled projects from sector, in which most of the restaurants. Rajasthan reported

outstanding projects. Completed On a sectoral basis, the completed projects were completed projects in road

Share in New Project Announcements (%) related to organic chemicals A state-level analysis shows transport infrastructure services

Latest data suggests that Investments services (other than financial) that Maharashtra, Uttar and education. Madhya Pradesh,

100.00 while the total value of sector witnessed the highest and drugs & pharmaceuticals. Pradesh, Rajasthan, Madhya on the other hand, reported

87.6

80.00 ongoing investments Pradesh and Tamil Nadu completed projects in drugs &

ew project 60.00 moderated albeit marginally The value of completed emerged as the top five states pharmaceuticals, while for Tamil

announcements in the to Rs 247.8 lakh crore in Q3 projects slumped on both Sectoral Breakup of Completed Projects with higher number of Nadu it was in the housing

third quarter of the current 40.00 FY24 from Rs 248.1 lakh sequential and annual basis (Rs lakh crore) completed projects in Q3 construction sector.

fiscal (Q3FY24) slumped on 20.00 12.4 crore in the previous quarter, standing at Rs 1.35 lakh crore Q2 FY24 Q3 FY24 FY24.

an annual basis, while marginal 0.00 it was higher than Rs 234.4 in Q3FY24 as compared to Rs

growth was recorded in lakh crore in the 1.67 lakh crore in the Services (other than financial) 0.80 1.01

comparison to the previous Q2 FY22 Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 Q4 FY23 Q1 FY24 Q2 FY24 Q3 FY24 corresponding quarter last previous quarter and Rs 1.86 States with Higher Value of Completed Projects in

Q3 FY24 (Rs lakh crore)

quarter. The overall new Government Private year, marking a growth of 5.7 lakh crore in the comparable Transport services 0.49 0.82 0.14

project announcements in Source: CMIE Capex database & CII Research per cent in year-on-year quarter last year. 0.12 0.13 0.12 0.11

Q3FY24 stood at Rs 2.21 lakh There has also been a terms. Manufacturing 0.48 0.17 0.10

crore, a tad higher than Rs noticeable improvement in 0.08

2.01 lakh crore in the capacity utilization of some from CMIE, the new projects A break-up of data showed VALUE OF COMPLETED Chemicals 0.12 0.07 0.07

previous quarter, while the sectors, especially the MANUFACTURING announced under the sector that private sector PROJECTS SLUMPED 0.06 0.05

level was less than even half of manufacturing sector. This SECTOR ATTRACTED mainly comprised of chemical investment, measured by the IN Q3FY24 Construction material 0.02 0.06 0.04

Rs 9.66 lakh crore recorded evidence gets strengthened by MORE INVESTMENTS products, metal products and value of ongoing investments, 0.02

in the corresponding quarter results of various surveys IN Q3FY24 increased to Rs 109.3 lakh The data suggests that the Electricity 0.05 0.12 0.00

last year. conducted by CII, to gauge transport equipment. Other crore in Q3FY24, registering a decline in value of completed Maharashtra Uttar Pradesh Rajasthan Madhya Pradesh Tamil Nadu

sectors attracting higher level

the on-ground recovery. As of new investments include double-digit growth of 17.1 projects was driven by both Source: CII Research analysis based on CMIE Capex database Source: CII Research Analysis based on CMIE Capex database

The sequential growth in new per the latest round of the At the sectoral level, services (other than financial) per cent on an annual basis, government as well as the

project announcements was CII-Business Outlook Survey between 75-100 per cent range of 75-100 per cent, manufacturing sector, despite and electricity. Within also marking an improvement private sector, which value of

led by the private sector, conducted in the month of during Q3FY24. In an which is noteworthy as weak external demand, from the previous quarter. On completed projects in the

which grew by 48 per cent December 2023, 45 per cent encouraging sign, in the last capacity utilization needs to attracted higher investments services, transport services the other hand, even though private sector contracting at a Going forward, government’s Further, to build consensus on could become the single point Commerce Ministry, External

did well.

on-quarter. On the other of the respondents felt that two surveys too, majority of be maintained between 75-80 in Q3FY24. As per the data the value of ongoing faster rate on an annual basis. continued push for capital land, labour and power reforms of contact for facilitating the Affairs Ministry, etc., besides

hand, the new project capacity utilization in their the respondents expect their per cent to fuel fresh expenditure, at both the at the state level, the successful opportunities for investment in other sectoral ministries, State

announcements by the company would range capacity utilization to be in investments in the economy. central and state levels, will model of GST Council could be India as well as for Indian governments, other Institutions

government plummeted both Sectoral Breakup of New Project Announcements Trend in Value of Completed Projects (Rs lakh crore) not only help crowd-in adopted. investors to invest abroad. and regulators like RBI, SEBI,

on sequential as well as an (Rs lakh crore) private investment at a higher Currently, the process of Stock exchanges, Banks, FIPB,

annual basis during the period. level, but also stimulate CII has also recommended investment for foreign investors Invest India, etc.

Sectors Q2 FY24 Q3 FY24 3.5 demand in other sectors setting up of an independent needs clearances from Finance

Encouragingly, the high Manufacturing 0.77 1.40 3 2.91 through its multiplier impact Ministry for Investment, which Ministry, Home Ministry,

frequency investment on growth.

indicators have remained Chemicals 0.14 0.64 2.5 2.16

healthy in the year so far. 2 1.38 1.86 It is important to invigorate

Moreover, data on net fixed Metals 0.06 0.28 1.42 1.40 0.54 0.86 1.54 1.67 private investments further

assets of 2000+ odd 1.5 1.25 0.37 1.35 and the government can take

companies extracted from Transport equipment 0.10 0.17 1 0.55 0.43 0.96 0.34 initiatives like expanding the

CMIE Prowess database 1.53 0.74 1.31 1.30 1.30 PLIs to some of the

showcase an increasing trend Services (other than financial) 0.43 0.39 0.5 0.87 0.52 0.97 0.58 1.01 labour-intensive sectors such

in H1 FY24, reaching its 0 as footwear, toys, etc; come

highest value in seven Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 Q4 FY23 Q1 FY24 Q2 FY24 Q3 FY24 up with an Employment

quarters. The continuous Transport services 0.37 0.22 Government Private Sector Total investments Linked Incentive Scheme (ELI)

uptick in value of net fixed Electricity 0.78 0.37 for select employment

assets reflects that companies incentive sectors; address

are more and more in favour Source: CII Research Analysis based on CMIE Capex database issues related to the Cost of

of investing, despite the Source: CII Research Analysis based on CMIE Capex database Doing Business, etc to help

uncertain economic revitalise private investment

landscape. in the economy.

14 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 15

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

FEBRUARY 2024 FEBRUARY 2024

according to Niti Aayog and are hesitant to under Article 6 of the Paris consider implementing a

RMI. The move encourages finance/refinance large-scale Agreement. It will help nationwide policy mandating

manufacturers and project green hydrogen projects. create a marketplace for the use of Green M15 fuel i.e.

developers to invest in green • The production cost of Indian green fuels like green mixing 15 per cent green

hydrogen and its derivatives various green fuel hydrogen and its methanol with petrol, in

like green ammonia and technologies, such as green derivatives, green methanol, transportation and other

methanol, putting India among hydrogen and its and SAF, among others, in applicable sectors, supported

those leading countries, such derivatives, is higher. the international market. by incentives for producers

as the United States and the However, grey hydrogen, • There’s a need for speeding and consumers to adopt this

European Union, which have alongside various grey up strategic interventions fuel. This could be a pivotal

allocated public funding for manufacturing methods, has for the Green Hydrogen step in India's journey

green hydrogen. towards a greener and more

historically benefited from Transition Program by

subsidies. Without a robust offering incentives for both sustainable future.

Establishing a market for green and liquid global carbon green hydrogen production • To ensure widespread

ammonia and methanol is a market, pricing the value of and electrolyser availability of Green M15 fuel,

global issue. In India, carbon and embedded manufacturing. These there’s a need for investment

forward-thinking standards by emissions in the production initiatives will catalyze in the necessary

the Bureau of Indian Standards, and usage of grey hydrogen industry growth. infrastructure for its

such as blending DME with becomes challenging. This is production, distribution, and

LPG and methanol with diesel, why, initially, green • The cost of renewable storage.

are significant steps towards hydrogen seems more energy can be further

integrating green fuels. reduced through energy • Campaigns should be

expensive than grey surplus banking provisions, launched to educate the

hydrogen.

especially for sectors public and other stakeholders

• The cost of funding remains mandated to use green about the benefits of using

a persistent bottleneck, hydrogen. Green M15 fuel and address

presenting a considerable • The government should misconceptions.

challenge for project implement targeted

developers, impacting the incentives to boost the By adopting these

optimization of capital export of green molecules. recommendations, India can

expenditure and project It will help establish India as make significant strides towards

execution. energy self-reliance,

a global leader in environmental sustainability, and

renewable energy.

Suggestions • A mechanism should be economic growth.

developed to facilitate Conclusion

Challenges To address the challenges, we low-cost financing and

provide benefits like

suggest that the government

take several steps to provide a accelerated depreciation This is the time to take

Despite government efforts much-needed boost to the for green hydrogen immediate action to overcome

to promote green hydrogen industry, such as: infrastructure investments. all the bottlenecks on the road

and its derivatives, the sector • The government should towards leading the global

is still in its infancy, and • As in the initial days of expand the FAME India transition to sustainable energy.

acknowledging and addressing renewable energy, the (Faster Adoption and With right policies in place and

the hurdles that impede our government mandated its Manufacturing of (Hybrid the development of a market for

full potential in this critical usage through Renewable &) Electric Vehicles in India) green methanol and ammonia,

sector is essential. Among the Purchase Obligation (RPO). Scheme to include green India can unlock the full

various challenges are - potential of green hydrogen and

Similarly, we suggest that a methanol vehicles in it. It its derivatives. Moreover, it will

• There isn’t much existing quota should be mandated will not only boost the provide a much-needed boost

demand and a developed for the use of green market but also provide for the production, distribution,

market ecosystem for hydrogen in sectors like support to the green and usage of green hydrogen and

green hydrogen and its fertilizers, chemicals, steel, hydrogen ecosystem in the its derivatives across sectors.

derivatives like green and power generation. country. Such initiatives will not only help

ammonia and methanol, not Creating demand through • There’s a need for funding India in achieving targeted

only in India but also policy will spur sectoral and support for research climate goals but also position it

globally, compared to other growth and reduce the and development in the as a leader in the green energy

conventional fuels. production cost of green areas of green hydrogen revolution.

hydrogen.

• Project developers face and methanol-based

difficulty in getting final • Leveraging its international technologies. It will further

offtake agreements signed. relations, the government help enhance efficiency and

should expedite the signing reduce costs.

• In the absence of advance

offtake contracts, lenders of bilateral agreements • The government should