Page 12 - CII Artha Magazine

P. 12

Domestic Trends

India’s ALL GLOBAL between February 2021 and Forex Reserves RBI interventions in the

banking system, through the

October 2022, the extent of

CURRENCIES HAVE

and Liquidity

forex market, have caused a

rupee’s depreciation at 13

DEPRECIATED

significant tightening of

percent has been lower as

AGAINST THE US

Exchange Rate: Dollar compared to the developed Thirdly, if RBI continues to liquidity in the system. Net

durable liquidity has come

market currencies like

DOLLAR

undertake foreign exchange

down from a peak of Rs 11.9

Japanese Yen (39.4), South

lakh crores on 8th October

interventions in order to

Korean Won (28.5), Euro (23),

2021 to Rs 2.6 lakh crores

control the fall in the rupee, it

Great Britain Pound (22.9)

is likely to bring down the

by 21st October 2022. And

and Australian Dollar (21.9),

An Analysis Strengthening as well as emerging market India's forex reserve cover. for the first time in over 2

years, the banking system

Already, India’s total forex

currencies like the Turkish

liquidity went into deficit

reserves have come down

Lira (161.7), Sri Lankan Rupee

of Rs. 0.22 lakh crores

from US$637.5 billion on 1st

(88), Pakistani Rupee (38.9),

October 2021 to US$531.1 by

(Rs. 21,873 crores) on 20th

Secondly, the depreciation in

Thai Baht (26.3), South

currencies has been across

to a fall in India’s forex import

to Rs. 0.60 lakh crores

the board as the US dollar African Rand (22.6), Philippine 28 October 2022. This has led September 2022 and again

Peso (21.7) and Malaysian

cover from 9.3 months to

(Rs. 60,091 crores) on

has strengthened. In fact, Ringgit (15.9) among others.

7.3 months. 30th October 2022.

NET DURABLE If RBI continues undertaking

LIQUIDITY HAS forex intervention to

manage the rupee, it could

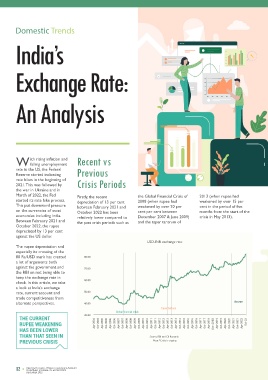

W falling unemployment Recent vs USD Index (DXY) COME DOWN IN THE potentially push interest

ith rising inflation and

FINANCIAL SYSTEM

rate in the US, the Federal Previous 115.0 rates much faster than it

may be comfortable with.

Reserve started indicating This raises the question on

rate hikes in the beginning of 110.0 More importantly, excess whether RBI’s forex

2021. This was followed by Crisis Periods 105.0 liquidity is no longer the case. interventions limit Monetary

the war in Ukraine and in Apart from other factors, the Policy independence.

March of 2022, the Fed Firstly, the recent the Global Financial Crisis of 2013 (when rupee had 100.0 withdrawal of rupees from the

started its rate hike process. depreciation of 13 per cent 2008 (when rupee had weakened by over 15 per 95.0

This put downward pressure between February 2021 and weakened by over 20 per cent in the period of five Net Durable Liquidity (Rs lakh crore)*

on the currencies of most October 2022 has been cent per cent between months from the start of the 90.0 14.0

economies including India. relatively lower compared to December 2007 & June 2009) crisis in May 2013). 85.0 11.9

Between February 2021 and the past crisis periods such as and the taper tantrum of 12.0

October 2022, the rupee Feb-21 Apr-21 Jun-21 Aug-21 Oct-21 Dec-21 Feb-22 Apr-22 Jun-22 Aug-22 Oct-22 10.0

depreciated by 13 per cent 8.0

against the US dollar.

USD-INR exchange rate Note: The U.S. dollar index (DXY) is a measure of the value of the U.S. dollar relative to a basket of 6.0

foreign currencies which includ the euro (EUR), Japanese yen (JPY), Canadian dollar (CAD), British

The rupee depreciation and pound (GBP), Swedish krona (SEK), and Swiss franc (CHF). 4.0

especially its crossing of the 2.0 2.6

80 Rs/USD mark has created 80.00

a lot of arguments both 01-Jan-21 12-Mar-21 07-May-21 02-Jul-21 10-Sep-21 05-Nov-21 14-Jan-22 11-Mar-22 06-May-22 01-Jul-22 09-Sep-22 07-Oct-22

against the government and 70.00 Percent Change in USD Exchange Rate b/w Feb'21 and Oct'22

the RBI on not being able to Net Liquidity Injected (Rs lakh crores)**

keep the exchange rate in 150% 1.0 0.2

check. In this article, we take 60.00 0.0

a look at India’s exchange -1.0

rate, current account and 50.00 100% -2.0

trade competitiveness from -3.0

-4.0

alternate perspectives. 40.00 Recent* 50% -5.0

Taper Tantrum -6.0

Global financial crisis -7.0

THE CURRENT 30.00 0% -8.0

RUPEE WEAKENING Apr-2004 Oct-2004 Apr-2005 Oct-2005 Apr-2006 Oct-2006 Apr-2007 Oct-2007 Apr-2008 Oct-2008 Apr-2009 Oct-2009 Apr-2010 Oct-2010 Apr-2011 Oct-2011 Apr-2012 Oct-2012 Apr-2013 Oct-2013 Apr-2014 Oct-2014 Apr-2015 Oct-2015 Apr-2016 Oct-2016 Apr-2017 Oct-2017 Apr-2018 Oct-2018 Apr-2019 Oct-2019 Apr-2020 Oct-2020 Apr-2021 Oct-2021 Apr-2022 Oct-22 Turkey Sri Lanka Japan Pakistan Thailand Euro Gre

HAS BEEN LOWER South Korea South Africa 01-Jan-21 01-Mar-21 01-May-21 01-Jul-21 01-Sep-21 01-Nov-21 01-Jan-22 01-Mar-22 01-May-22 01-Jul-22 01-Sep-22

THAN THAT SEEN IN Source: RBI and CII Research

PREVIOUS CRISIS Note: *Crisis is ongoing Source: RBI

*[surplus(+)/deficit(-)]

Source: ofx

**(outstanding including the day's operations)

12 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 13

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

DECEMBER 2022 DECEMBER 2022