Page 14 - CII Artha Magazine

P. 14

Trade rate of the rupee needs to be IN TERMS OF REER, account and loss in trade Thus, examining India’s REER been appreciating and has As can be seen from the above The exchange rate movement

also has other policy

panel, India’s exports are

competitiveness.

played a part in our reduced

and non-oil non-gold CAB is

looked at not only vis-à-vis

Competitiveness USD, but relative to all major THE RUPEE HAS India’s fall in oil and gold more instructive. India’s trade competitiveness as strongly correlated with global implications. The Government

of India has embarked on an

growth. While FY22 saw strong

WITNESSED AN

REER and non-oil non-gold

seen from the worsened

trading partners of India.

global growth, with global

imports on account of falling

ambitious project of building

CAB have a strong negative

non-oil non-gold Current

Further, it needs to be adjusted

and Current to changes in inflation in India APPRECIATION crude oil prices in the last relationship. Our REER has Account Balance (CAB). recessionary risks & demand Atmanirbharta. However, an

decade, have masked the

slowdown in FY23 negatively

appreciating REER is likely to

relative to the instead of these

Account major trading partners. This An increase in REER (i.e. simultaneous deterioration impacting India’s exports, it go counter to this project as it

in India’s non-oil non-gold

reduces India’s external trade

becomes even more important

requires examining the nominal

REER appreciation) implies

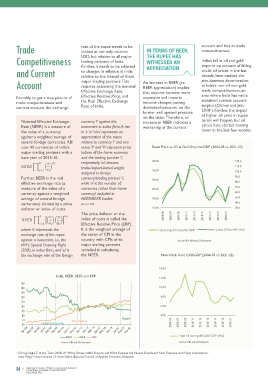

Effective Exchange Rate, that exports become more trade competitiveness, an 80.0 REER vs Non-Oil & Gold CAB/GDP 14.0% that India’s real exchange rate competitiveness. India thus

Fourthly, to get a true picture of Effective Relative Price, and expensive and imports area where India has had a 85.0 13.0% vis-à-vis its major trading needs an appropriate exchange

trade competitiveness and the Real Effective Exchange become cheaper, putting sustained current account 90.0 12.0% partners remains competitive. rate policy in conjunction with

11.0%

current account, the exchange Rate of India. downward pressure on the surplus (Chinoy and Jain, 95.0 10.0% schemes like PLI (Production

1

former and upward pressure 2018 ). Further, the impact 9.0% Linked Incentives).

on the latter. Therefore, an of higher oil price in rupee 100.0 8.0%

Nominal Effective Exchange currency ‘i’ against the increase in REER indicates a terms will happen, but oil 105.0 7.0%

6.0%

Rate (NEER) is a measure of numeraire in index form. A rise worsening of the current prices have started moving 110.0 5.0%

the value of a currency in ‘e’ or ‘e/ei’ represents an down in the last few months. 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21 2021-22

against a weighted average of appreciation of the rupee

several foreign currencies. RBI relative to currency ‘i’ and vice

uses 40 currencies of India’s versa. ‘P’ and ‘Pi’ represent price Brent Price vs Oil & Gold Imports/GDP (2004-05 to 2021-22) REER non oil non gold CAB/GDP (rhs)

major trading partners with a indices of the home economy Source: RBI and CII Research

base year of 2015-16. and the trading partner ‘i’,

respectively. ‘wi’ denotes 40.0% 120.0

trade-/export-based weight 110.0 This REER appreciation has relatively held up well when

assigned to foreign 35.0% 100.0 continued into this recent compared to many of India’s

Further, REER is the real currency/trading partner ‘i’, 30.0% 90.0 crisis period, unlike earlier major trading partners. In

effective exchange rate (a while ‘n’ is the number of 80.0 crisis periods where REER fact, the currencies of India’s

measure of the value of a currencies (other than home 25.0% 70.0 significantly depreciated. major trading partners have

currency against a weighted currency) included in 60.0 Between February’21 and fallen much more than the

average of several foreign NEER/REER basket. 20.0% 50.0 October’22, REER has rupee that it has lowered

currencies) divided by a price (Source: RBI) 40.0 appreciated by 0.1 per cent. India’s trade competitiveness

deflator or index of costs. 15.0% 30.0 This is because the rupee has over this time frame.

The price deflator or the

index of costs is called the 2004-05 2006-07 2008-09 2010-11 2012-13 2014-15 2016-17 2018-19 2020-21

Effective Relative Price (ERP). Global Financial 2013 Taper Feb’21 to

where ‘e’ represents the It is the weighted average of oil and gold imports/GDP brent price ($/barrel) (rhs) Crisis Tantrum Oct’22

exchange rate of the rupee the ratios of CPI in the REER -9.7% -4.7% 0.1%

against a numeraire, i.e., the country with CPIs of its Source: EIA, RBI and CII Research NEER -13.8% -10.3% -2.4%

IMF’s Special Drawing Right major trading partners ERP 4.8% 6.3% 2.6%

(SDR), in index form, and ‘ei’ is included in calculating

the exchange rate of the foreign the NEER. Non-Oil & Gold CAB/GDP (2004-05 to 2021-22) Source: RBI and CII Research

Note: negative/positive REER and NEER change implies depreciation/appreciation

14.0%

Correlation between Global Growth and Exports

India: NEER, REER and ERP

12.0% 27.0%

150 25.0%

140 10.0%

130 23.0%

120 8.0% real export growth (%) 21.0%

110

100 6.0% 19.0%

90 17.0%

80 4.0%

70 Taper Tantrum Recent -4.0% -2.0% 15.0% 0.0% 2.0% 4.0% 6.0% 8.0%

60 Global financial crisis 2004-05 2006-07 2008-09 2010-11 2012-13 2014-15 2016-17 2018-19 2020-21

Apr-04 May-05 Jun-06 Jul-07 Aug-08 Sep-09 Oct-10 Nov-11 Dec-12 Jan-14 Feb-15 Mar-16 Apr-17 May-18 Jun-19 Jul-20 Aug-21 Sep-22 real world GDP growth (%)

NEER REER ERP non oil non gold CAB/GDP (rhs) Source: WB WDI, RBI, CII Research

Source: RBI and CII Research Source: RBI and CII Research The panel looks at data from 2005 to 2021. It shows that growth rate of India’s exports is

significantly impacted by global growth.

1 Chinoy, Sajjid Z. & Jain, Toshi, 2018-19. “What Drives India’s Exports and What Explains the Recent Slowdown? New Evidence and Policy Implications,”

India Policy Forum, Volume 15. New Delhi: National Council of Applied Economic Research.

14 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 15

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

DECEMBER 2022 DECEMBER 2022