Page 29 - Artha

P. 29

India’s until it reaches a maximum of Additionally, India's weight in attracting approximately MIXED RECOVERY rebound to 0.3 per cent in WHILE HEADLINE Organization’s (FAO) Food CENTRAL BANKS inflation to decline slowly, and Similarly, the WTO projects a shipments, underscoring

worries that slowing overseas

Price Index has been slowly

recovery in world

the rate reductions are

Q1 2024 as against the

10 per cent by March 2025.

the MSCI Global Standard

US$2 billion in investments

inclusion in Consequently, India will share Index, which tracks emerging into India. US FDI inflows (US$ billion) 311 WITNESSED ACROSS contraction of 0.2 per cent in INFLATION IS EASING increasing over the past six NAVIGATE INFLATION projected to gather pace next merchandise trade volume economies will complicate

year. For 2024, the Fed eyes

DYNAMICS WITH

months following declines

policymakers' efforts to wind

with growth of 2.6 per cent in

the previous quarter. The UK

MAJOR ECONOMIES

UP, FOOD PRICES

equivalent weight with

stock markets, has reached

only one rate cut in the

Global Bond countries like China, Indonesia, another record high and is Furthermore, India’s China 163 economy continues to face CONTINUE TO POSE over much of 2023. The index DIVERSE STRATEGIES second half of the year. 2024 and 3.3 per cent in back on stimulus. Weak

exports are particularly

inched up to 120.8 in July

2025, following a significant

tepid household consumption,

inclusion in these global

anticipated to rise from the

and Mexico. India’s inclusion is

Indices likely to redistribute weights current 18.2 per cent to 19 bond indices would also France 42 Among the major economies, business investment, exports A SIGNIFICANT 2024 as compared to 117.7 in Easing of inflationary The cost-push inflation in decline of -1.2 per cent in worrisome for Japanese

CONCERN

2023.

policymakers who are banking

the beginning of the year in

contribute to lower 10-year

and imports.

per cent. This adjustment will

within the J.P. Morgan

pressures have prompted

Japan prompted its central

Emerging Market Bond Index, narrow the gap with China, bond yields due to the pace of growth is slower January. Indices for cereals, major central banks to initiate bank to increase rates for the Among key global economies, on external demand to help

India's inclusion of sovereign potentially reducing the shares whose weight is expected to participation of wider set of Germany 37 than the previous three years. Japan, which had been posting vegetable oils and dairy interest rate cuts, shifting second time in about 17 years exports from the UK, China, counter weak domestic

bonds in global indices such of Thailand, Poland, and the decrease slightly from 25.4 per investors in the global The US economy slowed to a robust growth in the With the inflation print falling products led to the price rise. their focus towards bolstering to 0.25 per cent in its July and the US have consumption.

as the J.P. Morgan Bond Index Czech Republic over the next cent to 25 per cent during the market. India 28 2.9 per cent in Q1 2024 as previous quarters, contracted faster than expected in most The food and beverage price their economic growth meeting. demonstrated notable Meanwhile, the European

starting June 2024 and 10 months. same period, potentially compared to 3.1 per cent in 0.2 per cent in Q1 2024. The regions, in the midst of index released by IMF, too, trajectory. improvements, contrasting Union's export sector has

Bloomberg Index from Indonesia 22 the previous quarter. The economy was squeezed by unwinding supply-side issues shows an uptrend. Meanwhile, central banks in with lacklustre performance faced challenges due to

January 2025 marks a 21 slowdown primarily reflected and restrictive monetary Among selected countries, Most central banks including some advanced countries, seen in the Eurozone and declining energy prices, and

significant milestone. It Japan slower growth in consumer weaker consumption and policy, the IMF expects global inflation in the US remained the US Fed have maintained a including the ECB, Canada, Japan. Both the latter further exacerbating

reflects heightened spending, exports as well as external demand, thereby inflation to decline steadily on the upper side of the pause in their interest rates in Switzerland Sweden and Bank economies are grappling with economic pressures.

confidence and interest 2023 2022 throwing a fresh challenge to from 6.8 per cent in 2023 to target band, averaging 3.2 per recent meetings to allow the of England have begun to ease subdued demand. Exports

among foreign investors in FDI outflows (US$ billion) state and local government the policymakers. 5.9 per cent in 2024 and 4.5 cent in the second quarter of impact of hikes done so far to their rate cycles, leading to an from Japan were dragged

India's growth trajectory. The US 404 spending. The employment per cent in 2025. The Fund the current year. work through the system. improvement in the global down by China-bound chip

move is expected to lower rate in the US also rose to a On the other hand, the expects the advanced demand and growth outlook.

the cost of capital by Japan 184 high of 4.3 per cent in July, the Chinese economy advanced economies to return to their Moreover, the US Fed

attracting additional highest since October 2021. 5.3 per cent in Q1 2024, inflation targets sooner than indicated that it expects

investment, thereby China 148 Meanwhile, the labour force marking the steepest the emerging market and THE UN FOOD AND

supporting the country's participation rate edged expansion since Q2 2023, developing economies. Core AGRICULTURE

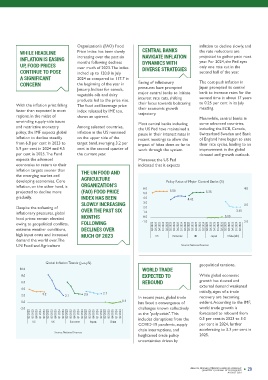

financing requirements and Germany 101 higher to 62.7 per cent in July lifted by continued support inflation, on the other hand, is ORGANIZATION’S Policy Rates of Major Central Banks (%)

boosting private sector from 62.6 per cent in June. measures from Beijing and projected to decline more (FAO) FOOD PRICE 6.0 5.50 4.0

investments. France 72 spending related to the Lunar gradually. INDEX HAS BEEN 5.0 5.25

Eurozone, which was largely New Year festival. In the first 4.0 4.42

3.0

On 28th June 2024, India Saudi Arabia 16 affected by the global turmoil, Despite the softening of SLOWLY INCREASING 2.0 3.5

officially joined J.P. Morgan's showed some resilience by three months of the year, inflationary pressures, global OVER THE PAST SIX 1.0 3.45

Government Bond Index – India 13 China’s fixed investment also food prices remain elevated MONTHS 0.0 0.10

Emerging Markets, initially rising to 0.4 per cent in Q1 grew by 4.5 per cent, the owing to geopolitical conflicts, FOLLOWING -1.0 3.0

with a one per cent weight. 2023 2022 2024. UK’s growth marked a most in nearly a year. extreme weather conditions, DECLINES OVER Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024

This weight is set to increase Source: UNCTAD World Investment report 2024 high input costs and increased

gradually, rising by one demand the world over. The MUCH OF 2023 US Eurozone UK Japan China (rhs)

percentage point monthly

In terms of outflows, FDI Conversely, outward UN Food and Agriculture Source: National Sources

flows from the developed investment from European

nations increased by 4 per countries fell by 11 per cent, Trajectory of Real GDP growth (y-o-y%) Global Inflation Trends (y-o-y%)

Global billion, while flows to economies, US, India and UK Notably, investments are cent to US$1.1 trillion in with notable decreases 5.3 10.0 WORLD TRADE geopolitical tensions.

observed in Germany, Sweden

2023. The United States and

developed economies fell by

increasing in sectors like

also appear in the top five

Investment 15 per cent. destinations for both automotive and electronics, Japan emerged as the leading and Spain, which are major 8.0 EXPECTED TO While global economic

sources of outward

sources of outward

growth has slowed and

REBOUND

6.0

greenfield projects as well as

particularly in regions with

Flows FDI inflows declined for most international project finance access to major markets. investment, with both investment. 2.9 4.0 3.2 2.5 2.7 external demand weakened

Further, FDI outflows from

countries seeing significant

initially, signs of a trade

reporting economies. About

deals.

However, many developing

two thirds of developed countries continue to face increases. Outward FDI from developing countries slowed 2.0 2.1 0.3 In recent years, global trade recovery are becoming

by 11 per cent to US$491

US increased by 10 per cent

Global foreign direct economies saw declines and Looking ahead to 2024, while difficulties in attracting foreign and by 14 per cent from billion in 2023. This decline 0.4 0.3 0.0 has faced a convergence of evident. According to the IMF,

investment (FDI) fell by 2.0 about half of the developing challenges persist, there is investment and integrating Japan, going against the overall was widespread across most -2.0 challenges known collectively world trade growth is

per cent to US$1.3 trillion in ones. US continued to remain potential for modest growth into global production trend for developed regions, although South-East US Eurozone UK Japan -0.2 China Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 as the "poly-crisis". This forecasted

2023, influenced by economic the largest FDI recipient, driven by improved financial networks, underscoring countries. Asia experienced a continued Q12023 Q22023 Q32023 Q42023 Q12024 US UK Eurozone Japan China includes disruptions from the 0.3 per cent in 2023 to 3.0

slowdowns and geopolitical accounting for almost a conditions and efforts to ongoing disparities in global growth in outward COVID-19 pandemic, supply per cent in 2024, further

tensions. Inflows into quarter of global flows. China facilitate investment through economic participation. investment. Source: National Sources Source: National Sources chain interruptions, and accelerating to 3.3 per cent in

developing countries, accounted for another ~12 national policies and heightened trade policy 2025.

previously robust, declined by per cent. Among the top international agreements. uncertainties driven by

7.0 per cent to US$867

28 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 29

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

AUGUST 2024 AUGUST 2024