Page 20 - CII ARTHA India’s Growth Prospects

P. 20

Global Trends

Global Growth previous month led by new Red Sea crisis are also to be China’s economy, although measures and a low base.

experienced a slowdown to

Excluding the pandemic years

order intakes. The momentum

looked out for as it provides

an important trade route for

through 2022, the 2023 GDP

4.9 per cent in Q3 2023,

of services sector, including

growth in China is the

almost 10 per cent of the

business activity, new orders

before rising to 5.2 per cent

Remains on and employment was world’s oil. in Q4 2023, on the back of a slowest pace of annual rise

since 1990, underscoring the

strong industrial production.

sustained, which resulted in

The full year growth (2023)

impact of a prolonged

the J.P Morgan Global

MIXED RECOVERY

Services PMI rising to a

property crisis, persistently

for China stands at 5.2 per

WITNESSED ACROSS

weak consumption, and global

six-month high of 52.3 in

cent as against 3.0 per cent in

MAJOR ECONOMIES

a Sticky January from 51.6 in Amongst the major 2022, amid various support turmoil.

December, thus remaining

above the 50 mark for the

Trajectory of Real GDP Across Key Global Economies (y-o-y%)

twelfth successive month.

7.0

Encouragingly, the J.P Morgan

economies, US economy grew

6.0

Territory Manufacturing too climbed to at 3.1 per cent year-on-year 5.0 3.1 1.0 5.2

50.0 in January 2024 from

in Q4 2023 as compared to

4.0

2.9 per cent in the previous

49.0 in the previous month

3.0

quarter, marking the strongest

supported by work on

2.0

rise in about two years,

existing contracts.

1.0

0.0

consumer spending and

Global commodity prices, reflecting increases in -1.0 0.1 -0.2

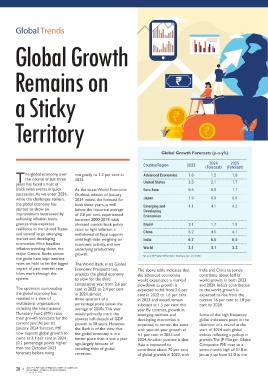

Global Growth Forecasts (y-o-y%) which have remained volatile inventory investment. As a US Eurozone UK Japan China Green Hydrogen s

in the aftermath of the result, the full year 2023 GDP Q12023 Q22023 Q32023 Q42023 v

2024 2025 Russia-Ukraine and growth came at 2.5 per cent, Note: The fourth quarter real GDP data for UK and Japan is not available Growth Potential a

Country/Region 2023 (Forecast) (Forecast) Israel-Hamas crisis, have a marginal and steady rise Source: National Sources h

T he global economy, over marginally to 3.2 per cent in Advanced Economies 1.6 1.5 1.8 started to show signs of from 2.0 per cent in 2022. US global inflation to decline g

d

softening in the recent

labour market has remained

the course of last three

2025.

years has faced a host of United States 2.5 2.1 1.7 months. Brent crude prices resilient, with its INFLATION, THOUGH steadily from 8.9 per cent in b

MODERATING, REMAINS

black swan events in quick As the latest World Economic Euro Area 0.5 0.9 1.7 have started to moderate unemployment rate remaining ABOVE TARGET RANGE 2023 and 5.8 per cent in 2024 t

succession. As we enter 2024, Outlook edition of January recently after breaching the steady at 3.7 per cent in ACROSS MAJOR and 4.4 per cent in 2025. The r

while the challenges remain, 2024 noted, the forecast for Japan 1.9 0.9 0.8 US$90 per barrel mark post January 2024. Bulk of the rise ECONOMIES core inflation is projected to n

the global economy has both these years, is well Emerging and 4.1 4.1 4.2 the Israel-Hamas conflict. Oil in unemployment rate from decline more gradually, and e

started to show an below the historical average Developing prices reached the US$79.8 low of 3.4 per cent in April to inflation is not expected to e

improvement buttressed by of 3.8 per cent experienced Economies per barrel in January 2024 as the current 3.7 per cent is Inflation, which emerged as a return to target until 2025 in i

softening inflation levels, between 2000-2019, with compared to an average of due to an influx of new big risk post the Russia’s most cases. h

greater-than-expected elevated central bank policy Brazil 3.1 1.7 1.9 US$77.6 per barrel in workers. The number of invasion of Ukraine last year, s the entire world complete decarbonisation is f

resilience in the United States rates to fight inflation, a December 2023. It is employed individuals stood at has started exhibiting signs of Among select countries, grapples with a severe only possible through According to Strategy & o

and several large emerging withdrawal of fiscal support China 5.2 4.6 4.1 important to note that the 161.2 million in the said softening from the elevated China reported a 0.3 per cent climate crisis, natural disasters technologies like green Research, global gree

market and developing amid high debt weighing on India 6.7 6.5 6.5 moderation in global brent period. levels but remains well above drop in CPI inflation in Q4 wreak havoc on millions of hydrogen and its derivatives. to exceed 530 million

hydrogen demand is expected

economies. With headline economic activity, and low crude prices came despite the the central bank’s target. With 2023, against 0.1 per cent lives and livelihoods annually These technologies offer

inflation trending down, the underlying productivity World 3.1 3.1 3.2 voluntary cuts announced by Eurozone is still reeling from the inflation print falling faster decline in the previous across the globe. To ensure the transformative potential for 2050, equivalent t

major Central Banks across growth. OPEC+ to the tune of 1.3 last year’s sharp spike in gas than expected in most quarter. The CPI deflation may survival of life on our planet, countries like India to establish per cent of g

the globe have kept interest Source: IMF World Economic Outlook, January 2024 million barrels per day till the prices due to the conflict regions, in the midst of put pressure on the energy consumption. This

rates on hold to let the lagged The World Bank, in its Global end of 2023. between Russia and Ukraine. unwinding supply-side issues government to consider energy transition has become themselves as global hubs for would displace 10 bi

impact of past interest rate Economic Prospects too, The above table indicates that India and China to jointly Its economy registered a and restrictive monetary additional fiscal stimulus to more crucial, given that critical producing green hydrogen, barrels of oil equi

hikes work through the projects the global economy the advanced economies contribute about half of An increase in US crude oil minimal growth of 0.1 per policy, the IMF expects the mitigate the challenge. thresholds have already been often referred to as the ‘next year, approximately

system. to slow for the third would experience a marked world growth in both 2023 inventories, rebound in US cent in Q4 2023 against no surpassed. Failing to take oil’. cent of the current global o

consecutive year, from 2.6 per slowdown as growth is and 2024. India’s contribution treasury yields and easing of growth in Q3 and 0.6 per sufficient action will lead to production. f

The optimism surrounding cent in 2023 to 2.4 per cent expected to fall from 2.6 per to the world growth is oil demand due to the global cent growth in Q2. The full 12.0 Inflation Across Key Global Economies (y-o-y%) even more severe conse- c

the global economy has in 2024, almost cent in 2022 to 1.6 per cent expected to rise from the slowdown may have year 2023 growth for quences. Thus, adopting a However, the green hydrogen

resulted in a slew of three-quarters of a in 2023 and would remain current 16 per cent to 18 per contributed to the decline in Eurozone decelerated sharply 10.0 multifaceted approach to market in India is likely to

multilateral organizations percentage point below the subdued at 1.5 per cent this cent by 2028. crude prices in November to 0.5 per cent in 2023 from 8.0 energy transition is essential h

including the International average of 2010s. This year year. By contrast, growth in and December. However, even 3.5 per cent in 2022. UK 6.0 to reduce carbon emissions. reach US$30-35 billion by

Monetary Fund (IMF) raise would primarily mark the emerging markets and Some of the high frequency though the crude oil prices economy, too, reported its 4.0 4.2 2035-2040, as per ICF - a

their growth forecasts for the slowest half-decade of GDP developing economies is global indicators point in the remain steady so far, going first contraction since 2021 as 2.0 3.2 2.9 In line with this, there has global advisory and technolo

current year. As per its growth in 30 years. However, expected to remain the same direction of a revival at the forward, the trajectory of its real GDP declined by 0.2 2.7 been increased impetus on services provider. w

January 2024 forecast, IMF the Bank is of the view that with year-on-year growth at start of 2024 with global crude oil prices remain per cent in Q4 2023. Its full 0.0 -0.3 renewable power generation M

now expects global growth to the global economy is in a 4.1 per cent in 2023 and indices reflecting a pickup in contingent on the evolving year growth also decelerated -2.0 for electricity and electric With an abundance of natural

come at 3.1 per cent in 2024 better place than it was a year 2024. Another positive is that growth. The JP Morgan Global global scenario and any sharply from 4.3 per cent in Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 vehicles for mobility. However, resources, including ov

(0.2 percentage points higher ago, largely because of Asia is expected to Composite PMI rose to a frequent cuts announced by 2022 to a mere 0.2 per cent US UK Eurozone Japan China b

than the October 2023 receding risks of global contribute about 70 per cent seven-month high of 51.8 in the OPEC+. Furthermore, the in 2023. Source: National Sources c

forecast) before rising recession. of global growth in 2023, with January, up from 51.0 in the developments in the recent

20 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 21

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

FEBRUARY 2024 FEBRUARY 2024

according to Niti Aayog and are hesitant to under Article 6 of the Paris consider implementing a

RMI. The move encourages finance/refinance large-scale Agreement. It will help nationwide policy mandating

manufacturers and project green hydrogen projects. create a marketplace for the use of Green M15 fuel i.e.

developers to invest in green • The production cost of Indian green fuels like green mixing 15 per cent green

hydrogen and its derivatives various green fuel hydrogen and its methanol with petrol, in

like green ammonia and technologies, such as green derivatives, green methanol, transportation and other

methanol, putting India among hydrogen and its and SAF, among others, in applicable sectors, supported

those leading countries, such derivatives, is higher. the international market. by incentives for producers

as the United States and the However, grey hydrogen, • There’s a need for speeding and consumers to adopt this

European Union, which have alongside various grey up strategic interventions fuel. This could be a pivotal

allocated public funding for manufacturing methods, has for the Green Hydrogen step in India's journey

green hydrogen. towards a greener and more

historically benefited from Transition Program by

subsidies. Without a robust offering incentives for both sustainable future.

Establishing a market for green and liquid global carbon green hydrogen production • To ensure widespread

ammonia and methanol is a market, pricing the value of and electrolyser availability of Green M15 fuel,

global issue. In India, carbon and embedded manufacturing. These there’s a need for investment

forward-thinking standards by emissions in the production initiatives will catalyze in the necessary

the Bureau of Indian Standards, and usage of grey hydrogen industry growth. infrastructure for its

such as blending DME with becomes challenging. This is production, distribution, and

LPG and methanol with diesel, why, initially, green • The cost of renewable storage.

are significant steps towards hydrogen seems more energy can be further

integrating green fuels. reduced through energy • Campaigns should be

expensive than grey surplus banking provisions, launched to educate the

hydrogen.

especially for sectors public and other stakeholders

• The cost of funding remains mandated to use green about the benefits of using

a persistent bottleneck, hydrogen. Green M15 fuel and address

presenting a considerable • The government should misconceptions.

challenge for project implement targeted

developers, impacting the incentives to boost the By adopting these

optimization of capital export of green molecules. recommendations, India can

expenditure and project It will help establish India as make significant strides towards

execution. energy self-reliance,

a global leader in environmental sustainability, and

renewable energy.

Suggestions • A mechanism should be economic growth.

developed to facilitate Conclusion

Challenges To address the challenges, we low-cost financing and

provide benefits like

suggest that the government

take several steps to provide a accelerated depreciation This is the time to take

Despite government efforts much-needed boost to the for green hydrogen immediate action to overcome

to promote green hydrogen industry, such as: infrastructure investments. all the bottlenecks on the road

and its derivatives, the sector • The government should towards leading the global

is still in its infancy, and • As in the initial days of expand the FAME India transition to sustainable energy.

acknowledging and addressing renewable energy, the (Faster Adoption and With right policies in place and

the hurdles that impede our government mandated its Manufacturing of (Hybrid the development of a market for

full potential in this critical usage through Renewable &) Electric Vehicles in India) green methanol and ammonia,

sector is essential. Among the Purchase Obligation (RPO). Scheme to include green India can unlock the full

various challenges are - potential of green hydrogen and

Similarly, we suggest that a methanol vehicles in it. It its derivatives. Moreover, it will

• There isn’t much existing quota should be mandated will not only boost the provide a much-needed boost

demand and a developed for the use of green market but also provide for the production, distribution,

market ecosystem for hydrogen in sectors like support to the green and usage of green hydrogen and

green hydrogen and its fertilizers, chemicals, steel, hydrogen ecosystem in the its derivatives across sectors.

derivatives like green and power generation. country. Such initiatives will not only help

ammonia and methanol, not Creating demand through • There’s a need for funding India in achieving targeted

only in India but also policy will spur sectoral and support for research climate goals but also position it

globally, compared to other growth and reduce the and development in the as a leader in the green energy

conventional fuels. production cost of green areas of green hydrogen revolution.

hydrogen.

• Project developers face and methanol-based

difficulty in getting final • Leveraging its international technologies. It will further

offtake agreements signed. relations, the government help enhance efficiency and

should expedite the signing reduce costs.

• In the absence of advance

offtake contracts, lenders of bilateral agreements • The government should