Page 22 - Artha

P. 22

State of States

AUTO & COMPONENTS underperformance. The construction materials sectors Trends in

AND CONSUMER improvement in external experienced a decline in net Outlook

DURABLES ARE demand may have been sales compared to the same

DRIVING THE reflected in the net sales in quarter in the previous year.

CORPORATE the first quarter. The Looking ahead, the

PERFORMANCE IN consumer durables sector Additionally, sectors including outlook for corporate State Capex

Q1FY25 saw robust growth, driven by auto & components, FMCG, profitability remains

an unusually early onset of Healthcare and IT reported positive, contingent on

summer and extreme higher PAT margin during the both domestic and global

On the sectoral front, several heatwaves, which spurred first quarter of the current year, economic developments

industries such as agri, auto & higher demand for cooling indicating improved profitability shaping the business

components, capital goods, products from households. in these areas. Encouragingly, in landscape in the coming

consumer durables and The automotive sector also the FMCG companies, the raw year.

he Indian corporates have On the expenditure front, textiles achieved double-digits delivered a strong material prices have largely C entral government led Rs 14,186 crores released in

sustained a robust companies managed to curtail net sales growth. Notably, the performance, bolstered by stabilized and tailwinds from There are upbeat capital spending has 2021-22 and Rs 11,830 crores

performance in the first their costs significantly, with textile sector exhibited signs substantial sales of passenger lower input prices are also indicators emerging in been among the key engines paid during 2020-21.

quarter of the current fiscal, expenditure growth slowing of recovery in Q1FY25, after vehicles. In contrast, the pointing towards a more sectors like textiles and driving a synchronous

as early indicators suggest. to 2.0 per cent in Q1FY25, several quarters of logistics, metals & mining, and volume led growth. consumer durables, rebound in the Indian Further, the Centre provided

down from 3.8 per cent in which are showing signs economy. Hence, despite around Rs 1.09 lakh crore in

the previous quarter and 14.3 of an upturn in growth. being ravaged by the 50-year interest-free loans in

per cent in Q1FY24. This pandemic and geopolitical 2023-24 to all states for

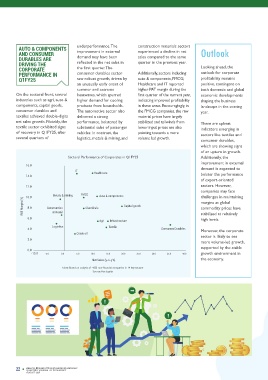

notable reduction in spending Sectoral Performance of Corporates in Q1FY25 Additionally, the disruption, the economy is capex which is 4 per cent

was primarily due to a 16.0 improvement in external doing exceptionally well as higher than the revised

moderation in employee cost, IT Healthcare demand is expected to demonstrated by its estimate of Rs 1.05 lakh crore

which grew by just 5.2 per 14.0 bolster the performance phenomenal growth during the year. In the Union

cent and a 0.2 per cent of export-oriented performance. But for growth Budget, the amount was

As per CII’s analysis of ~670 contraction in the cost of 12.0 sectors. However, to be sustained, it is vitally increased to Rs 1.5 lakh

non-financial companies from services & raw materials Aided by both lower interest is making enough profits to FMCG companies may face important that state capital crore. This is in response to

Ace Equity, excluding during the first quarter. expenses and stable profit meet its interest liabilities. 10.0 Metals & mining Auto & components challenges in maintaining expenditure should the increased demand and

petroleum products, early Meanwhile, profit margins rates, companies have margins as global complement the center, to rising absorptive capacity of the state capex during the last State capex has more than

trends suggest a moderation surged to 10.2 per cent in demonstrated a notable In Q1FY25, the ICR at 7.7 3$7 0DUJLQ 8.0 Construction Chemicals Capital goods commodity prices have jointly enhance the overall loans by states which are five years. States have also doubled from Rs. 3.48 lakh

in net sales to 4.2 per cent in Q1FY25, higher than the 9.8 enhancement in their interest was higher than 7.3 in the materail stabilized at relatively productive capacity of the deploying additional funds to contained their revenue crore in 2019-20 to Rs 6.54

Q1FY25 as against substitute per cent margin in Q4FY24 as coverage ratio (ICR). The ICR, previous quarter and 7.4 in 6.0 Agri Infrastructure high levels. economy. fill infrastructural gaps across deficit which has provided lakh crore in 2023-24. The

the by a growth of 5.9 per well as 9.7 per cent in the calculated as a ratio of profit the corresponding quarter Logistics Textile varied sectors such as them with the fiscal space for latest data shows that state

cent in the previous quarter. comparable quarter last year. before interest and tax (PBIT) last year. This improvement is 4.0 Consumer Durables Moreover, the corporate CENTRE AIMS TO housing, roads, irrigation etc. capital investment and it is capex has gone up by as much

This growth was also much Lower growth in expenditure and the interest cost, particularly encouraging given Crude oil sector is likely to see BOOST STATES IN Fund disbursal went up hoped that the trend will as 23.8 per cent year-on-year

lower as compared to the and interest costs have indicates the debt servicing the context of prevailing 2.0 more volume-led growth, CAPITAL EXPENDITURE further to Rs 95,000 crores continue in 2024-25. in 2023-24 as against 16.7 per

11.9 per cent net sales contributed positively to capability of a company as it higher interest rates in the supported by the stable THROUGH 50-YEAR during April-February 2024 as cent in 2022-23 supported by

growth recorded in Q1FY24. profit margins. shows whether the company country. 0.0 -10.0 -5.0 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 growth environment in INTEREST FREE LOAN special assistance to states for Presently, states are marching their robust revenue growth

Net Sales (y-o-y%) the economy. TO STATES capital investment. The in lockstep with the Centre and the Centre’s interest-free

interest-free loans from the to accelerate their investment capex loans.

Note: Based on analysis of ~685 non-financial companies in 14 key sectors Centre have contributed, in a in infrastructure development.

Source: Ace Equity

To provide a requisite push to major way, towards helping

state capex, the Centre has the states increase their

started with the ‘Scheme for capex. State Capex in Last Five Years

Special Assistance to the (Rs lakh crore)

States for Capital Investment' 17 LARGE STATES 6.54

in 2020-21, which has seen a HAVE SEEN A 5.28

steady rise in allocation since ROBUST EXPANSION 4.52

then. Disbursements by the IN THEIR CAPEX 3.48 3.46

Centre to the states under SPENDING IN LAST

this Scheme have been FIVE YEARS

showing a sharp rise over the

initial two years of its

announcement. The Centre In fact, a review of the FY20 FY21 FY22 FY23 FY24

released Rs 81,195 crore to finances of 17 large states Note: Includes capex spending by select 17 large States

states in 2022-23 which is have shown that there has Source: CAG

significantly higher than the been a significant expansion in

22 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 23

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

AUGUST 2024 AUGUST 2024