Page 19 - Artha

P. 19

Domestic Trends

CII remains optimistic about investment, and an anticipated merchandise trade should

India's economic prospects, rebound in global trade. OPTIMISM AROUND increase by 2.6 per cent in Trends in

projecting an impressive Headwinds from geopolitical REVIVAL IN PRIVATE 2024 after falling by 1.2 per

growth rate of 8 per cent in tensions, volatility in CAPEX cent in 2023. Further,

the current fiscal year. This international commodity strategic Free Trade

optimism is rooted in three prices, and geoeconomic Agreements (FTAs) and Public Capex

key factors: stabilization of fragmentation, however, pose Private sector investment is preferential pacts with trading

inflation, resurgence in private risks to the outlook. expected to revive. Increased partners are set to enhance

private sector savings and India's exports further. The

improved corporate expected positive shift in

Real GDP Growth (y-o-y%) global trade dynamics,

30.0 profitability in the recent combined with India's robust

period signal ample financial

18.9 resources for further services exports and rising

20.0 investment. RBI’s recent FTAs, is expected to position I n India, the current government consumption

14.2 13.4 the country favourably on the expansionary cycle is that of expenditure, however, grew at

9.6 survey has put manufacturing

10.0 capacity utilization at 76.5 per external front. a capex-led boom. There has a much slower rate.

6.4 9.7 been a sharp uptick in the

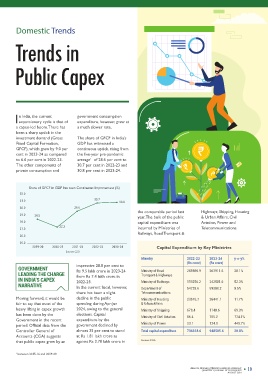

7.0 8.2 8.0 cent in Q4 of 2023-24 from The Indian economy's investment demand (Gross The share of GFCF in India’s

0.0 3.9 -1.2 74.7 per cent in the preceding

quarter, suggesting increased resilience and robust growth Fixed Capital Formation, GDP has witnessed a

GFCF), which grew by 9.0 per

continuous uptick, rising from

trajectory, supported by

-10.0 -5.8 private investment activity as strong domestic fundamentals, cent in 2023-24 as compared the five-year pre-pandemic

FY20 FY21 FY22 FY23 FY24 FY25 (F) businesses expand to meet

1

he Indian economy has next five years, as per the Real Nominal demand. has positioned it as a global to 6.6 per cent in 2022-23. average of 28.6 per cent to

demonstrated remarkable projections of the growth leader. CII remains The other components of 30.7 per cent in 2022-23 and

resilience and strength, International Monetary Fund Note: F is CII Forecast While global growth has optimistic about India’s private consumption and 30.8 per cent in 2023-24.

Source: CSO

defying prevailing global (IMF). During this period, as slowed down and external economic growth, projecting

economic and geopolitical per CII Research projections, demand has weakened thus an impressive growth of 8 per

headwinds. With a India’s GDP is projected to inflation is expected to far, signs of a rebound in cent in fiscal year 2024-25 Share of GFCF in GDP has seen Continuous Improvement (%)

higher-than-expected real more than double from THE FORECAST OF subside on account of global trade are now and its ascent to become the 32.0

GDP growth of 8.2 per cent US$3.5 trillion to US$ 8 Private consumption remains domestic demand drivers, ABOVE-NORMAL receding El Nino conditions emerging. According to the third largest economy by 31.0 30.7

in 2023-24, India has firmly trillion, thereby gliding to its strong with steady therefore, appear robust, and an anticipated World Trade Organisation 2027. 30.8

established itself as the fastest position as the third-largest discretionary spending in providing a strong buffer MONSOON TO ACT AS above-normal monsoon (WTO), the volume of world 30.0 29.6 the comparable period last Highways, Shipping, Housing

growing major economy in economy globally. urban areas. The one against looming challenges. A POTENTIAL GAME predicted by the IMD. This is 29.0 28.5 year. The bulk of the public & Urban Affairs, Civil

the world for three year-ahead, RBI’s consumer CHANGER IN expected to enhance 28.0 capital expenditure was Aviation, Power and

consecutive years. In tandem The remarkable performance confidence remains in the On the external front, India’s STABILIZING PRICES agricultural productivity and 27.3 incurred by Ministries of Telecommunications.

with its strong growth of the Indian economy is optimistic terrain in May. resilient services export water reservoir levels, 27.0 Railways, Road Transport &

potential, India's stock market underpinned by robust Rural demand is also reviving growth has played a pivotal stabilizing food inflation. 26.0

recently crossed the US$5.0 macroeconomic fundamentals, with improvement in farm role in stabilizing the Headline inflation is already Assuming a normal monsoon, 25.0

trillion valuation, making it the thriving manufacturing and sector activity. Growth of economy, keeping the current showing signs of softening, CII projects CPI inflation to 2019-20 2020-21 2021-22 2022-23 2023-24 Capital Expenditure by Key Ministries

fourth largest equity market services sector, and buoyant retail two-wheeler sales, account deficit at manageable declining from 6.7 per cent in moderate from 5.4 per cent Source: CSO

globally and giving it a place domestic demand. Further, moderation in contraction of levels, and mitigating the 2022-23 to 5.4 per cent in in 2023-24 to 4.5 per cent in Ministry 2022-23 2023-24 y-o-y%

among the world’s stock the government’s strategic tractor sales and pick up in impact of global economic 2023-24, primarily due to a 2024-25, aligning closer to the impressive 28.8 per cent to (Rs crore) (Rs crore)

market superpowers. focus on investment in FMCG volume growth fluctuations. In 2023-24, moderation in core inflation. RBI's target of 4.0 per cent. GOVERNMENT Rs 9.5 lakh crore in 2023-24 Ministry of Road 205985.9 263911.6 28.1%

infrastructure- both physical suggest a recovery in rural services exports surged by Extreme volatility in food LEADING THE CHARGE from Rs 7.4 lakh crore in Transport & Highways

& digital- while maintaining demand. The reduction in 4.9 per cent to US$341 IN INDIA’S CAPEX 2022-23. Ministry of Railways 159256.2 242581.6 52.3%

fiscal prudence has fortified demand for MNREGA jobs by billion, propelled by the rapid NARRATIVE In the current fiscal, however,

macroeconomic growth and 14.3 per cent year-on-year in proliferation of Global 10.0 CPI Inflation (y-o-y%) there has been a slight Department of 54728.6 59380.2 8.5%

Telecommunications

stability. The robustness of the May 2024 reflects an Capability Centres (GCCs) in 8.0 Moving forward, it would be decline in the public

economy is evident from the improvement in regular India. Additionally, foreign 6.0 fair to say that most of the spending during Apr-Jun Ministry of Housing 23676.7 26441.1 11.7%

& Urban Affairs

high-frequency data, including employment. Further, the direct investment (FDI) 4.5 heavy lifting in capex growth 2024, owing to the general

The increasing prominence of rising manufacturing and prospects of an above-normal inflows have shown robust 4.0 has been done by the elections. Capital Ministry of Shipping 678.4 1148.6 69.3%

Indian economy on the global services PMI, high credit monsoon by the Indian growth in recent years, with 2.0 Government in the recent expenditure by the Ministry of Civil Aviation 86.4 755.2 774.1%

stage is also reinforced by its growth, and robust GST Meteorological Department India maintaining its status as 0.0 period. Official data from the government declined by Ministry of Power 23.1 124.9 440.7%

substantial share in global collections in the first quarter (IMD) are expected to boost the leading destination for Controller General of almost 35 per cent to stand Total capital expenditure 736318.6 948505.6 28.8%

GDP, which is expected to of current fiscal, confirming an agricultural productivity and greenfield FDI in the 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 (F) Accounts (CGA) suggests at Rs 1.81 lakh crore as

rise from the current 16 per improvement in industrial bolster rural demand. These Asia-Pacific region. that public capex grew by an against Rs 2.78 lakh crore in Source: CGA

cent to 18 per cent over the activity.

Note: F is CII Forecast

Source: MOSPI

1 between 2015-16 and 2019-20

18 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 19

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

AUGUST 2024 AUGUST 2024