Page 22 - CII ARTHA India’s Growth Prospects

P. 22

Sector in Focus

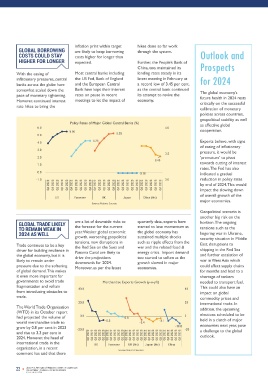

inflation print within target hikes done so far work

GLOBAL BORROWING are likely to keep borrowing through the system. Empowering

COSTS COULD STAY costs higher for longer than Outlook and

HIGHER FOR LONGER expected. Further, the People’s Bank of

China, too, maintained its Prospects

With the easing of Most central banks including lending rates steady in its

inflationary pressures, central the US Fed, Bank of England latest meeting in February at for 2024 India's Green

banks across the globe have and the European Central a record low of 3.45 per cent,

somewhat scaled down the Bank have kept their interest as the central bank continued The global economy’s

pace of monetary tightening. rates on pause in recent its attempt to revive the future health in 2024 rests

However, continued interest meetings to let the impact of economy. critically on the successful

rate hikes to bring the

calibration of monetary Hydrogen

policies across countries,

geopolitical stability as well

Policy Rates of Major Global Central Banks (%) as effective global

6.0 4.0

5.50 cooperation.

5.0 5.25 Revolution

4.25 Experts believe, with signs

4.0

of easing of inflationary

3.0 pressure, it would be Green Hydrogen sunshine days, wind energy,

3.5 vast wasteland, long coastlines,

2.0 ‘premature’ to pivot Challenges, Potential, and

3.45 and a skilled workforce, India

1.0 towards cutting of interest Growth Potential has the potential to produce

rates. The Fed has also

0.0 -0.10 indicated a gradual Key Strategies for green hydrogen and its

-1.0 3.0 reduction in policy rates derivatives at scale to cater to

both domestic and interna-

Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 by end of 2024. This would a Sustainable Future HYDROGEN AND tional demand. However,

AMMONIA ARE

impact the slowing down

of overall growth of the ENVISAGED TO BE realizing this potential

US Eurozone UK Japan China (rhs) necessitates coordinated

major economies. THE FUTURE FUELS

Source: National Sources efforts from various stakehold-

TO REPLACE FOSSIL ers, including governments,

Geopolitical scenario is FUELS industries especially in the

another big risk on the hard-to-abate sectors, and

GLOBAL TRADE LIKELY are a lot of downside risks to quarterly data, exports have horizon. The ongoing s the entire world complete decarbonisation is financial institutions, among

TO REMAIN WEAK IN the forecast for the current started to lose momentum as tensions such as the A grapples with a severe only possible through According to Strategy & others.

2024 AS WELL year. Weaker global economic the global economy has lingering war in Ukraine, climate crisis, natural disasters technologies like green Research, global green

growth, worsening geopolitical sustained multiple shocks security situation in Middle hydrogen demand is expected

tensions, new disruptions in such as ripple effects from the wreak havoc on millions of hydrogen and its derivatives. to exceed 530 million tons by Government

Trade continues to be a key the Red Sea on the Suez and war and the related food & East, disruptions to lives and livelihoods annually These technologies offer

driver for building resilience in Panama Canal are likely to energy crisis. Import demand shipping in the Red Sea across the globe. To ensure the transformative potential for 2050, equivalent to around 7 Initiatives

the global economy, but it is drive the projections too started to soften as the and further escalation of survival of life on our planet, countries like India to establish per cent of global primary

likely to remain under downwards for 2024. growth slowed in major war in West Asia which energy transition has become themselves as global hubs for energy consumption. This

pressure due to the softening Moreover, as per the latest economies. could affect supply chains more crucial, given that critical producing green hydrogen, would displace 10 billion In line with this, the

of global demand. This makes for months and lead to a thresholds have already been often referred to as the ‘next barrels of oil equivalent per Government of India has

it even more important for shortage of tankers surpassed. Failing to take oil’. year, approximately 37 per launched the National Green

governments to avoid trade Merchandise Exports Growth (y-o-y%) needed to transport fuel. sufficient action will lead to cent of the current global oil Hydrogen Mission with a

fragmentation and refrain This could also have an even more severe conse- production. financial outlay of Rs 17,490

from introducing obstacles to 40.0 40 impact on global quences. Thus, adopting a crore for supply-side

trade. commodity prices and multifaceted approach to However, the green hydrogen incentives for electrolyzer

20.0 20 international trade. In energy transition is essential market in India is likely to manufacturing and green

The World Trade Organisation addition, the upcoming to reduce carbon emissions. reach US$30-35 billion by hydrogen production. It has

(WTO) in its October report elections scheduled to be 2035-2040, as per ICF - a also set targets of at least 5

had projected the volume of 0.0 -0.6 0 held in a clutch of major In line with this, there has global advisory and technology MTPA of green hydrogen

production capacity by 2030,

world merchandise trade to -5.8 -5.4 -3.1 been increased impetus on services provider. which could increase up to 10

grow by 0.8 per cent in 2023 -20.0 -10.8 -20 economies next year, pose renewable power generation MTPA with export aspirations.

and rise to 3.3 per cent in a challenge to the global for electricity and electric With an abundance of natural Its domestic hydrogen demand

2024. However, the head of Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 outlook. vehicles for mobility. However, resources, including over 300 is expected to reach 11 MTPA

international trade in the US Eurozone UK (rhs) Japan (rhs) China by 2030, including a 46 per

organisation, in a recent Source: National Sources Vineet Mittal, Co – Chair, CII Renewable cent share of green hydrogen,

comment has said that there Energy Council and Chairman, AVAADA Group

22 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 23

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

FEBRUARY 2024 FEBRUARY 2024

according to Niti Aayog and are hesitant to under Article 6 of the Paris consider implementing a

RMI. The move encourages finance/refinance large-scale Agreement. It will help nationwide policy mandating

manufacturers and project green hydrogen projects. create a marketplace for the use of Green M15 fuel i.e.

developers to invest in green • The production cost of Indian green fuels like green mixing 15 per cent green

hydrogen and its derivatives various green fuel hydrogen and its methanol with petrol, in

like green ammonia and technologies, such as green derivatives, green methanol, transportation and other

methanol, putting India among hydrogen and its and SAF, among others, in applicable sectors, supported

those leading countries, such derivatives, is higher. the international market. by incentives for producers

as the United States and the However, grey hydrogen, • There’s a need for speeding and consumers to adopt this

European Union, which have alongside various grey up strategic interventions fuel. This could be a pivotal

allocated public funding for manufacturing methods, has for the Green Hydrogen step in India's journey

green hydrogen. towards a greener and more

historically benefited from Transition Program by

subsidies. Without a robust offering incentives for both sustainable future.

Establishing a market for green and liquid global carbon green hydrogen production • To ensure widespread

ammonia and methanol is a market, pricing the value of and electrolyser availability of Green M15 fuel,

global issue. In India, carbon and embedded manufacturing. These there’s a need for investment

forward-thinking standards by emissions in the production initiatives will catalyze in the necessary

the Bureau of Indian Standards, and usage of grey hydrogen industry growth. infrastructure for its

such as blending DME with becomes challenging. This is production, distribution, and

LPG and methanol with diesel, why, initially, green • The cost of renewable storage.

are significant steps towards hydrogen seems more energy can be further

integrating green fuels. reduced through energy • Campaigns should be

expensive than grey surplus banking provisions, launched to educate the

hydrogen.

especially for sectors public and other stakeholders

• The cost of funding remains mandated to use green about the benefits of using

a persistent bottleneck, hydrogen. Green M15 fuel and address

presenting a considerable • The government should misconceptions.

challenge for project implement targeted

developers, impacting the incentives to boost the By adopting these

optimization of capital export of green molecules. recommendations, India can

expenditure and project It will help establish India as make significant strides towards

execution. energy self-reliance,

a global leader in environmental sustainability, and

renewable energy.

Suggestions • A mechanism should be economic growth.

developed to facilitate Conclusion

Challenges To address the challenges, we low-cost financing and

provide benefits like

suggest that the government

take several steps to provide a accelerated depreciation This is the time to take

Despite government efforts much-needed boost to the for green hydrogen immediate action to overcome

to promote green hydrogen industry, such as: infrastructure investments. all the bottlenecks on the road

and its derivatives, the sector • The government should towards leading the global

is still in its infancy, and • As in the initial days of expand the FAME India transition to sustainable energy.

acknowledging and addressing renewable energy, the (Faster Adoption and With right policies in place and

the hurdles that impede our government mandated its Manufacturing of (Hybrid the development of a market for

full potential in this critical usage through Renewable &) Electric Vehicles in India) green methanol and ammonia,

sector is essential. Among the Purchase Obligation (RPO). Scheme to include green India can unlock the full

various challenges are - potential of green hydrogen and

Similarly, we suggest that a methanol vehicles in it. It its derivatives. Moreover, it will

• There isn’t much existing quota should be mandated will not only boost the provide a much-needed boost

demand and a developed for the use of green market but also provide for the production, distribution,

market ecosystem for hydrogen in sectors like support to the green and usage of green hydrogen and

green hydrogen and its fertilizers, chemicals, steel, hydrogen ecosystem in the its derivatives across sectors.

derivatives like green and power generation. country. Such initiatives will not only help

ammonia and methanol, not Creating demand through • There’s a need for funding India in achieving targeted

only in India but also policy will spur sectoral and support for research climate goals but also position it

globally, compared to other growth and reduce the and development in the as a leader in the green energy

conventional fuels. production cost of green areas of green hydrogen revolution.

hydrogen.

• Project developers face and methanol-based

difficulty in getting final • Leveraging its international technologies. It will further

offtake agreements signed. relations, the government help enhance efficiency and

should expedite the signing reduce costs.

• In the absence of advance

offtake contracts, lenders of bilateral agreements • The government should