Page 15 - Artha

P. 15

Domestic Trends

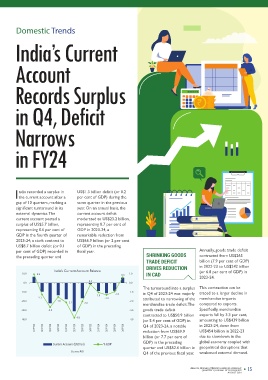

growth in employment R&D becomes more are already in place. The time CII’s research analysis of net there was a notable uptick in strengthened corporate with trading partners has ARDL model does not model. Additionally, two basis of Schwarz Information data sources, except data for reduction in imports of software, travel and business

stimulates aggregate demand attractive, further enhancing is opportune for industry to fixed assets data from 4000+ absolute terms to Rs 25.1 governance. It has enabled opened new export markets require all variables to be dummy variables representing Criterion (SIC). employment and net fixed India’s Current vegetable oils, gems and services.

for goods and services, production capabilities and come forward and start non-financial private sector lakh crore in H2FY24 from Rs banks and financial institutions and enhanced its integrated of the same order, the global financial crisis and assets which have been jewellery (excluding gold),

perpetuating a cycle of workforce skills. This creates investing to give the companies extracted from 24.2 lakh crore in both H1 to address non-performing competitiveness. With the thus accommodating both I(0) the Covid-19 pandemic were The analysis covers the obtained from RBI’s KLEMS chemicals and related In addition to the strong

consumption and production. a self-reinforcing cycle of high above-described virtuous CMIE Prowess Database FY24 and H2 FY23. This rise assets (NPAs) efficiently, signing of FTAs with countries and I(1) series without included to isolate the effects period from 1996 to 2022 database and CMIE’s Prowess products, plastic and rubber, services trade performance,

Additionally, the increased and sustainable economic cycle of growth the suggests that although a indicates improved leading to more robust like Mauritius, the UAE, necessitating pre-testing for of these significant economic using data at annual frequency. database, respectively. Account and transport equipment, net private transfer receipts,

production capabilities growth. much-needed momentum. moderation was witnessed in confidence and positive balance sheets and increased Australia, and the European unit roots. This is particularly disruptions. The lag length of Majority of the variables are among others, further primarily driven by workers’

The multiplier effects of support higher exports, As per the latest data from year-on-year growth terms, sentiment among private confidence in the financial Free Trade Association advantageous given the mixed each model is selected on the sourced from government contributed to the overall remittances, have

private investment are opening new markets and Overall, private investment in the Central Statistics companies. sector. IBC, along with Asset (EFTA), Indian industry has order of integration often decline in the import bill. demonstrated a growth of 5.1

extensive and multifaceted. deepening integration into a specific industry sets in Organization (CSO), private Quality Review of the RBI has gained access to global observed in macroeconomic Records Surplus per cent to US$107 billion in

Private capex in an industry, global value chains, which motion a self-reinforcing cycle sector savings have increased helped in improving the markets, providing them with data. Further, the model ARDL Model Summary Results 2023-24 from US$101 billion

such as establishment of new further bolsters aggregate of growth that extends to from 10.0 per cent of GDP in health of India's financial opportunities to expand allows us to capture both in the previous fiscal year.

manufacturing plants or income and employment ancillary industries and the 2011-12 to 11.2 per cent of sector with low levels of production capacities and short and long-term dynamics Key explanatory variable coefficients in Q4, Deficit

adoption of advanced opportunities. broader economy. This GDP in 2022-23, which could stressed assets, high earnings, integrate into global supply between the variables, 2 Overall, the narrowing of

technologies, leads to virtuous circle of growth is an be deployed for further and strong capital and chains. thereby providing a nuanced Model Dependent Variable nfa nfa(-1) nfa(-2) nfa(-3) nfa(-4) Adj R India's current account deficit

enhanced production As the economy grows, new adaptation of the investment. Corporate liquidity buffers. The understanding of underlying (1) realg 0.27*** 0.19* 0.01 0.13*** 0.26*** 0.99 can be attributed to a

capabilities. Efficient opportunities for investment Accelerator-Super Multiplier profitability has also consistent reduction in gross The potential for private economic processes. (2) empl 0.14*** -0.13*** 0.01 0.13*** - 0.99 Narrows significant reduction in the

production processes result and innovation emerge, Model developed by Nobel improved in 2023-24 NPAs of Scheduled investment to drive India's merchandise trade deficit,

in expansion of industry's initiating a virtuous cycle of Laureates Paul Samuelson and compared to the previous Commercial Banks, from 11.2 economic growth and We estimate three separate (3) export 2.63*** -0.11 -0.11*** 1.72*** 0.32 0.95 robust growth in services

output, directly creating growth. As investment in John Hicks . fiscal year. Net profit of per cent in 2018 to 3.9 per development is immense. The ARDL models to capture the Complementing the exports, and increasing

1

numerous jobs. The increase technological upgrades and private firms in Q4 of cent in 2023, has resulted in government has done the dynamic relationship between Note: */**/*** indicate significance at 0.10/0.05/0.01 per cent levels. Complete model results are available upon request. in FY24 Merchandise imports saw a imports fell by 14.5 per cent, narrowing merchandise trade private transfers, particularly

Source: CII Research

in employment raises the 2023-24 saw an annual an improvement in asset groundwork; it is now up to private investment, with Net more pronounced decline of from US$209 billion in deficit, robust services remittances, which have

disposable income of growth of 16.2 per cent quality and adequately the private sector to take the Fixed Assets (nfa) of private 7 per cent, decreasing from 2022-23 to US$179 billion in exports cushioned the collectively fortified India's

households, which in turn compared to 15.3 per cent in capitalized them to provide baton and lead India towards companies taken as a proxy, The results suggest that on export growth and four period lagged NFA on US$686 billion to US$638 2023-24. The decline in crude current account balance. The external sector and provided

boosts the demand for goods the same quarter of 2022-23, financing for investment sustained economic and specific economic private investment has a employment growth in real GDP growth and three billion over the same period. oil prices led to diminished services trade surplus surged a buffer against global

and services. indicating increased financial projects. prosperity. With favourable indicators, including real GDP statistically significant and subsequent lag after an initial period lagged NFA on The more significant drop in import bill for petroleum to US$163 billion (or 4.6 per economic and geopolitical

resources for investment. investment climate and growth (rgdp), employment the import bill is largely products, despite a modest uncertainties. As India

As production ramps up in a Several factors reflect the business, has significantly A slew of measures proactive engagement of growth (empl) and export immediate positive impact on boost may be explained by employment and export I ndia recorded a surplus in US$1.3 billion deficit (or 0.2 explained by a substantial 0.8 per cent increase in the cent of GDP) in 2023-24, up continues to navigate these

from US$143 billion (or 4.3

boosted investors’ confidence

the growth of real GDP,

temporary inefficiencies and

growth, indicating the

specific industry, it creates anticipated rebound in and improved investment announced in the Union industry, private investment growth (export). Following employment and exports. This disruptions. As investments sustained impact of private the current account after a per cent of GDP) during the decrease in imports of volume of petroleum per cent of GDP) in the challenges, strong external

significant demand for raw private sector investment. climate. Reforms to enhance Budget 2024-25, including will be the cornerstone of three models were used: underscores the pivotal role begin to yield benefits, such as investment over time. gap of 10 quarters, marking a same quarter in the previous petroleum crude and products imported in previous fiscal year. This position will be essential for

materials and components, Capacity utilization in ease of doing business such as setting up of integrated India's journey to becoming a of private investments, such increased production capacity Policymakers should significant turnaround in its year. On an annual basis, the products, which constitute a 2023-24. Crude oil prices fell increase is largely driven by ensuring sustained economic

stimulating growth in the manufacturing has also risen the National Single Window technology platform for developed economy by 2047. Model 1: Real GDP growth as technological upgrades and and improved efficiency, their therefore prioritize measures external dynamics. The current account deficit significant 26.5 per cent of from US$93.5/barrel in the growth in service exports, growth and stability.

upstream sectors, thereby to 76.5 per cent in Q4 of System, Shram Suvidha Portal improving outcomes under is dependent variable and key capacity expansion, in positive effects become to enhance the investment current account posted a moderated to US$23.2 billion, India’s import basket (as of 2022-23 to US$82.3/barrel in particularly in sectors such as

forming backward linkages. 2023-24 from 74.7 per cent and India Industrial Land Bank, IBC, reforms and Estimating the explanatory variables include boosting economic growth, evident over time leading to climate, as sustained private surplus of US$5.7 billion, representing 0.7 per cent of 2023-24). The value of these 2023-24. Additionally,

Simultaneously, increased in the preceding quarter, along with acts like the Jan strengthening of tribunal and net fixed assets, employment employment creation and renewed growth. investment is crucial for representing 0.6 per cent of GDP in 2023-24, a

output of the specific industry reaching well above the Vishwas Bill and The appellate tribunals to speed impact of growth and export growth export performance. This is reflected in positive long-term economic GDP in the fourth quarter of remarkable reduction from

creates forward linkages by long-term average of 73.8 Mediation Act 2023, have up insolvency resolution, However, the observed and significant coefficient of prosperity. 2023-24, a stark contrast to US$66.9 billion (or 2 per cent

stimulating growth in per cent. The latest round of A good investment climate collectively contributed to digitization of land records, private Model 2: Employment negative coefficient of NFA US$8.7 billion deficit (or 0.1 of GDP) in the preceding

downstream sectors, CII Business Confidence provides opportunities and creating a more favourable etc. are expected to further growth is a dependent per cent of GDP) recorded in fiscal year. SHRINKING GOODS Annually, goods trade deficit

enhancing productivity and Survey (Apr-Jun 2024) reveals incentives for the private business environment, enhance ease of doing investments variable and key explanatory the preceding quarter and contracted from US$265

competitiveness across these Indian economy has to shift that nearly half of the sector to invest profitably, thereby facilitating investment. business and encourage variables include net fixed TRADE DEFICIT billion (7.9 per cent of GDP)

sectors. Consequently, gears such that industry respondents expect capacity create jobs and expand Initiatives like PM Gati Shakti private investment. on key assets, real GDP growth and DRIVES REDUCTION in 2022-23 to US$242 billion

investment in one industry emerges as the primary utilization levels in their output. The government has National Master Plan and the export growth 10.0 0.9 India’s Current Account Balance 0.6 1.0 IN CAD (or 6.8 per cent of GDP) in

creates a ripple effect in catalyst for growth by companies to be above 75 implemented several National Logistics Policy are The PLI scheme has emerged macroeconomic -0.2 2023-24.

ancillary industries, enhancing creating a virtuous cycle. This per cent in Q1 FY25 and 45 measures to create a aimed at improving as a key driver of domestic Model 3: Export growth is 0.0 0.0

demand, productivity and job virtuous cycle can help lift the per cent of respondents conducive environment for infrastructure and manufacturing growth and parameters dependent variable and key -10.0 -1.0 The turnaround into a surplus This contraction can be

creation through these Indian economy out of the The building blocks of growth, anticipate an increase in their private investment. connectivity, ultimately export competitiveness. By explanatory variables include -1.3 -1.0 -1.0 in Q4 of 2023-24 was majorly traced to a larger decline in

multiplier effects. middle-income trap and move characterized by domestic domestic investment plans reducing the cost of doing incentivizing production and net fixed assets, real GDP -20.0 -1.5 -2.1 -2.0 -1.3 -2.0 attributed to narrowing of the merchandise imports

towards the vision of macroeconomic stability, during this period. The Government’s focus on business and enhancing exports across 14 strategic CII Research has undertaken growth and employment merchandise trade deficit. The compared to exports.

At an aggregate level, this becoming a developed nation robust policy mechanisms, increase in capacity utilization simplifying the business investments. industries such as electronics, time series analysis to growth -30.0 -2.6 -3.0 goods trade deficit Specifically, merchandise

chain reaction of increased by 2047. It is essential for the strong external account, is likely to drive private environment through reforms automobiles, pharmaceuticals, empirically examine the -40.0 -3.8 -4.0 contracted to US$50.9 billion exports fell by 3.3 per cent,

production and investment industry to now step in and physical & digital investment activity as like the reduction in The implementation of the and chemicals, the scheme is impact of private investments Rupee-US dollar exchange (or 5.4 per cent of GDP) in amounting to US$439 billion

leads to amplified production be an active participant in infrastructure impetus, businesses expand to meet corporate tax rates, Insolvency and Bankruptcy poised to spur investments on economic growth, rate, 10-year government Q1 FY22 Q2 FY22 Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 Q4 FY23 Q1 FY24 Q2 FY24 Q3 FY24 Q4 FY24 Q4 of 2023-24, a notable in 2023-24, down from

capabilities throughout the India’s growth story in the innovation and R&D thrust, demand. decriminalization of minor Code (IBC) in 2016 has and position Indian industry employment and exports securities yield and global reduction from US$69.9 US$454 billion in 2022-23

economy. The resultant Amrit Kaal. offenses, and initiatives to on a global scale. India's using the Autoregressive growth were also included as billion (or 7.7 per cent of due to slowdown in the

foster ease of doing business substantially improved the strategic engagement through Distributed Lag (ARDL) fixed regressors in each Current Account (USD bn) % GDP GDP) in the preceding global economy coupled with

and reduce the cost of doing debt recovery mechanism and FTAs and preferential pacts model. quarter and US$52.6 billion in geopolitical disruptions that

Source: RBI

Q4 of the previous fiscal year. weakened external demand.

14 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 15

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

AUGUST 2024 AUGUST 2024