Page 17 - CII Artha Magazine

P. 17

Domestic Trends

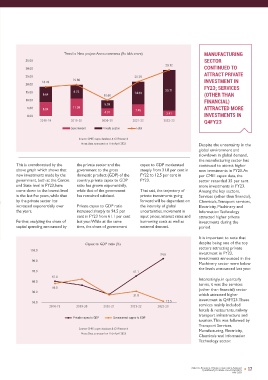

Investment 35.00 Trend in New project Announcements (Rs lakh crore) 29.12 MANUFACTURING

SECTOR

CONTINUED TO

Trends 30.00 18.49 19.80 21.79 25.71 ATTRACT PRIVATE

25.00

INVESTMENT IN

20.00

FY23; SERVICES

15.00

FINANCIAL)

10.00 9.64 8.72 10.00 14.33 (OTHER THAN

5.09

5.00 8.84 11.08 ATTRACTED MORE

4.91 7.45 3.41

0.00 INVESTMENTS IN

2019-20

I nvestments are crucial to A breakup shows that 2018-19 Government 2020-21 2021-22 2022-23 Q4FY23

investment in both the public

Private sector

Total

sustain growth. Since the

onset of the pandemic, the and private sectors

government has been taking experienced an increase on Source: CMIE capex database & CII Research

the lead in pushing capex sequential terms in Q4FY23, Note: Data extracted on 11th April 2023 Despite the uncertainty in the

projects to bolster growth in with new investments made global environment and

by the private sector growing

the economy. There are signs at a faster rate as compared slowdown in global demand,

that the private sector is also to that made by the This is corroborated by the the private sector and the capex to GDP moderated the manufacturing sector has

continued to attract higher

working in tandem with the government. The new above graph which shows that government to the gross steeply from 31.8 per cent in new investments in FY23. As

government in kickstarting the investments made by the new investments made by the domestic product (GDP) of the FY22 to 12.5 per cent in per CMIE capex data, the

investment cycle, which is private sector in Q4FY23 government, both at the Centre country, private capex to GDP FY23. sector recorded 35 per cent

essential for spurring growth stood at Rs 11.3 lakh crore as and State level in FY23, have ratio has grown exponentially, more investments in FY23.

via its multiplier effect. compared to Rs 0.98 lakh come down to the lowest level while that of the government That said, the trajectory of Among the key sectors,

This section analyses in detail crore made by the in the last five years, while that has remained subdued. private investments going Services (other than financial),

the recent trends in government. by the private sector has forward will be dependent on Chemicals, Transport services,

investments based on the Taking stock of the full year increased exponentially over Private capex to GDP ratio the intensity of global Electricity, Machinery and

CMIE Capex database, which FY23, overall new investments the years. increased sharply to 94.5 per uncertainties, movement in Information Technology

input prices, interest rates and

cent in FY23 from 61.1 per cent

would help assess the impact reached Rs 29.1 lakh crore, Further, analyzing the share of last year. While at the same borrowing costs as well as attracted higher private

investments during the

of recent initiatives being improving by 33.7 per cent capital spending announced by time, the share of government external demand. period.

taken by both government and over the previous year. The

industry to facilitate bulk of the increase in the It is important to note that

investment revival. new investments in FY23 was despite being one of the top

driven by the private sector, Capex to GDP ratio (%) sectors attracting private

thereby reflecting improved progressing at the rate of 40 industries. Moderation in 110.0 investment in FY23,

OVERALL NEW sentiments in the sector. The kms per day, till recently, has commodity prices, easing of 94.5 investments announced in the

INVESTMENTS REPORT private sector accounted for now slowed down to about supply chains and better 90.0 Machinery sector were below

growth prospects than

33 kms per day. Although, the

AN IMPROVEMENT IN 88 per cent of the total pace has improved from 20 anticipated earlier have 70.0 61.1 the levels announced last year.

investments (government +

FY23 private) in FY23 as against 66 kms per day (till December bolstered the sentiments of 51.0 Interestingly, in quarterly

per cent in the previous year. 2022), it still remains quite industry. The resilience shown 50.0 terms, it was the services

by the domestic economy

low. The major reasons for

On the government side, the

New share of total new the slowdown have been have helped companies to 30.0 46.8 31.8 (other than financial) sector

which attracted higher

execute their expansion plans.

delays in land acquisition,

investments announced in

Investments FY23 dropped to 12 per cent delayed payments and This trend is also reflected in 10.0 2018-19 2019-20 2020-21 2021-22 2022-23 investment in Q4FY23. These

12.5

services mainly included

clearances, and dispute

the OBICUS survey done by

from 34 per cent last year.

resolution delays leading to the RBI, where capacity hotels & restaurants, railway

Overall new investments in The slowdown in the financial stress. utilization (CU) for the Private capex to GDP Government capex to GDP transport infrastructure and

the economy improved to Rs government sector project manufacturing sector tourism. This was followed by

12.3 lakh crore in Q4FY23 as execution has especially been At the same time, investment improved to 74.3 per cent in Source: CMIE capex database & CII Research Transport Services,

against Rs 6.9 lakh crore in in the roads sector. For in the private sector has Q3 FY23 from 74.0 per cent Note: Data extracted on 11th April 2023 Manufacturing, Electricity,

the previous quarter and Rs instance, according to slowly and steadily recovered, recorded in the previous Chemicals and Information

9.04 lakh crore in the same government estimates, road with capacity utilization having quarter. Technology sector.

quarter last year. construction that was crossed trend levels in several

16 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 17

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

MAY 2023 MAY 2023