Page 20 - CII Artha Magazine

P. 20

Domestic Trends

Sector-wise gaining momentum in the Corporate

aftermath of the pandemic.

Most of the high frequency

A sector-wise analysis of indicators pertaining to the

ongoing investments shows sector showcase robust

that among the sectors, the growth, including air

services (other than financial) passenger traffic, hotel

sector attracted the highest occupation rate, e-commerce, Performance

investment of Rs 98.0 lakh travel & tourism, etc.

crore in FY23. Services here

include transport logistics, The sectors attracting higher

retail trading as well as ongoing investments also

natural gas trading & include Electricity, Chemicals,

distribution. Construction & Real estate,

Metals and Irrigation.

T uncertainties in the the corresponding quarter

The services sector has been he volatility and quarter and 31.7 per cent in

global environment since the last year. Notwithstanding the

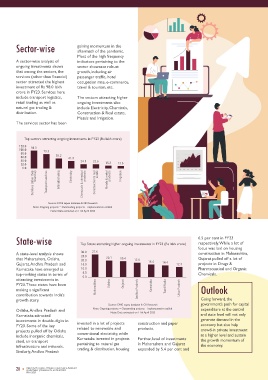

Top sectors attracting ongoing investments in FY23 (Rs lakh crore) beginning of the war in moderation, net sales

120.0 98.0 Ukraine last year have continue to post double-digit

growth. The muted topline

100.0 79.3 impacted all countries, in both

80.0 developed and emerging performance is mainly

60.0 55.2 41.3 attributable to inflationary

40.0 24.1 23.6 markets. The resultant impact

20.0 15.3 13.6 on volatility in commodity headwinds weighing on

0.0 estate prices, and major supply-side consumer sentiments, an

Services (other than financial) Transport services Manufacturing Electricity Chemicals & chemical products Construction & real Metals & metal products Irrigation permeated into the and muted external demand.

uneven recovery in sectors

bottlenecks industry wide, has

performance of the corporate

Net profits contracted by 15

sector as well. Besides, the

recent developments in global

quarter, as compared to

financial conditions have per cent in the reporting

Source: CMIE capex database & CII Research expansion of 19.1 per cent

Note: Ongoing projects = Outstanding projects – implementation stalled further affected the earning of Encouragingly, the net margins helped to ease input prices

Note: Data extracted on 11th April 2023 corporates in the third seen in the same quarter last of corporates witnessed a pressures on the corporates.

quarter of FY23 (3QFY23) year and a contraction of 21.3 bounce back in the third The PAT margin improved to

per cent in the previous

quarter, attributable to high quarter, albeit at a mild pace, 6.3 per cent in Q3FY23

borrowing costs prevailing in helped by moderation in against 6 per cent in the

previous quarter.

commodity prices, which

State-wise 6.5 per cent in FY23 CORPORATE SALES the economy.

DECELERATE IN

respectively. While a lot of

Top States attracting higher ongoing investments in FY23 (Rs lakh crore)

focus was laid on housing Q3FY23 WHILE PAT

A state-level analysis shows 30.0 27.6 construction in Maharashtra, MARGINS RISE Corporate Performance Snapshot

25.0

that Maharashtra, Odisha, 20.0 20.1 19.4 17.6 Gujarat pulled off a lot of

Gujarat, Andhra Pradesh and 15.0 15.4 14.4 12.3 projects in Drugs & 70.0 65.1 12.0

Karnataka have emerged as 10.0 Pharmaceutical and Organic Despite an anticipated

top-ranking states in terms of 5.0 Chemicals. increase in demand during 60.0 50.8 10.0

0.0

attracting investments in Q3FY23 due to the festive 50.0

FY23. These states have been Odisha Gujarat Karnataka and holiday season, a 37.6 6.3 8.0

making a significant Maharashtra Andhra Pradesh Tamil Nadu Uttar Pradesh Outlook moderation in net sales was 40.0 31.7 6.0 6.0

contribution towards India’s noted during the quarter. As 30.0 25.5 29.0

growth story. Going forward, the per CII analysis of 2380 odd 19.2 4.0

Source: CMIE capex database & CII Research government’s push for capital companies (excluding oil & 20.0 15.6

Odisha, Andhra Pradesh and Note: Ongoing projects = Outstanding projects – implementation stalled expenditure at the central gas and financial companies) 10.0 2.0

Note: Data extracted on 11th April 2023

Karnataka attracted and state level will not only using CMIE Prowess database,

investments in double-digits in invested in a lot of projects generate demand in the the net sales growth 0.0 Q4FY21 Q1FY22 Q2FY22 Q3FY22 Q4FY22 Q1FY23 Q2FY23 Q3FY23 0.0

FY23. Some of the key related to renewable and construction and paper economy but also help moderated in both sequential

products.

projects pulled off by Odisha conventional electricity, while crowd-in private investment as well as annual terms in Net Sales (% y-o-y) PAT Margin (%) (rs)

include inorganic chemicals, at a higher level and sustain 3QFY23. It stood at 15.6 per Source: CMIE Prowess Database and CII Research

steel, air transport Karnataka invested in projects Further, level of investments the growth momentum of cent in Q3FY23 as compared Note: Includes analysis of 2380 non-financial listed companies

in Maharashtra and Gujarat

pertaining to natural gas

infrastructure and minerals. trading & distribution, housing the economy. to 29 per cent in the previous

Similarly, Andhra Pradesh expanded by 5.4 per cent and

20 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 21

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

MAY 2023 MAY 2023