Page 22 - CII Artha Magazine

P. 22

State of States

Sectoral sector growth in net sales Metals & Mining saw subdued hand, sectors such as Building

Automotive, Transport &

was driven by premiumization

PAT margins in 3QFY23 on an

Trends: A mix through SUV demand, while annual basis. These sectors Logistics, Retail get the

were adversely impacted by

benefit from high pent-up

IT sector sales remained

of good and strong due to healthy demand lower realizations owing to demand and return of pricing Human

for India’s software service

power, while on the other

easing global commodity

bad exports in FY23. prices A slowdown in global hand, sectors such as Textiles,

demand is another factor

Metals & Mining, Consumer

However, the impact of which is likely to impact these Durables and FMCG face

The dampening effect of high slowing external demand and sectors. However, sectors pressure from weak external

inflation levels on consumers’ softening of commodity witnessing an uptick in PAT demand and high inflation. Capital for

purchasing power along with prices impinged on the net margins in Q3FY23 include

slowing external demand has sales growth of sectors such sectors such as IT, Pharma,

impacted the volume growth as metals & mining, Power, Transport & Logistics Outlook

in some sectors. construction and consumer as well as FMCG. Festive led

durables sectors which grew demand, cost rationalization, Going forward, as the Economic

Our analysis shows that, at a slower pace in the third easing input prices and economy is poised for a

among the 17 major sectors quarter on an annual basis. sustained economic activity slowdown in the current

(these include Oil & Gas and The net sales of Textiles resulted in higher PAT fiscal, the corporate sector

financial companies) that we contracted on an annual basis margins for this cohort. growth could remain Growth

track, except Textiles and in the reporting quarter. In subdued as well. While a

Financial Services, all other sequential terms, sectors such Sequentially, Consumer recovery in rural demand

sectors posted a positive as Automotive, Oil & Gas, Durables, Metals & Mining, and improvement in

annual growth in net sales in Financial Services, Metals & Pharmaceutical and Textile consumer sentiments [State-level Analysis]

Q3FY23. Sectors such as Mining, Pharmaceuticals, sectors witnessed subdued could strengthen the

Automotive, Power, IT, Power, Telecommunication PAT margins in the said FMCG, Retail and other

Transport & Logistics among services and Textiles reported quarter. sectors, the outlook for

others, posted a double-digit a contraction in net sales in sectors dependent on

growth in net sales indicative Q3FY23. The often talked about global demand remains

of easing supply chains, pickup uneven recovery in demand uncertain amid global

in semiconductor chip Of the 17 sectors, sectors gets mirrored in the patchy recessionary concerns. t a time when the global are States responding to the

supplies and growing such as Textiles, Oil & Gas, performance of net sales and A financial crisis has felt need to invest in human

economic activity. Automotive Real Estate & Construction, margins for sectors. On one

accelerated the shift in capital by providing the

economic power to emerging requisite resources for

economies, India is well poised improving the quality of the

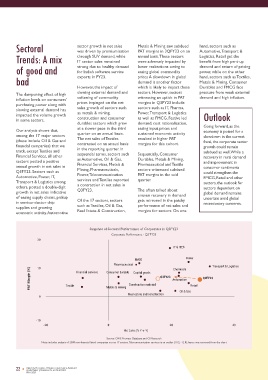

Snapshot of Sectoral Performance of Corporates in Q3FY23 to emerge as a front-runner in education system and

Corporate Performance - Q3'FY23

20 driving global growth, aided by developing market-oriented

its demographic potential and skills?

IT & ITES

investment in human capital. In

this context, good quality THE SHARE OF

FMCG Power education would be a critical

Pharmaceutical Chemicals Transport & Logistics lever, which would help EXPENDITURE

DEVOTED TO

10

PAT Margin (%) Textile Financial services Consumer durable Construction material Q3FY23 Automotive Retail Q2FY23 harness the potential of its EDUCATION HAS

Capital goods

human capital and boost the

DECLINED IN

nation’s economic growth

MAJORITY OF STATES

Metals & mining

implementation of policies

Real estate and construction Oil & Gas prospects. And since the IN THE POST share of expenditure devoted around 13.6 per cent in both

0 PANDEMIC YEARS to education and allied 2021-22 and 2022-23.

related to education and skill activities has declined in Doubtless some individual

training lies largely within the majority of states in the post states, such as Punjab and

domain of the states, it would A comparison between pandemic years. This is borne Bihar, have shown a rise in the

be crucial for states to take 2019-20, the pre-pandemic

-10 the lead in setting aside funds year and 2021-22 (RE), the out from the fact that the share of education in total

-20 0 20 40 aggregate expenditure of expenditure in 2021-22 but

Net Sales (% Y-o-Y) for developing human capital post-pandemic year, shows states on educational services the increase has been marginal

in the state and country. that even as most states have

Source: CMIE Prowess Database and CII Research increased their education as a percentage of total and not enough to make a

Note: includes analysis of 2380 non-financial listed companies across 17 sectors. Telecommunication services is an outlier (10.2, -12.8), hence was removed from the chart expenditure has dropped from meaningful difference.

Against this backdrop, the budgets in absolute terms in 15.1 per cent in 2019-20 to

question arises is that: How far 2021-22 over 2019-20, the

22 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 23

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

MAY 2023 MAY 2023