Page 18 - CII Artha Magazine

P. 18

Domestic Trends

CII Business Majority of the respondents (66 results, however, revealed that 54 of the respondents (58 per respondents expect the

per cent) feel that the Indian

cent) anticipate that RBI will

current phase of acceleration

per cent of the respondents

stick with a pause on the

in inflation to be a transitory

indicated muted global growth

economy will grow in the range

and high inflation/input costs as

of 6.0-7.0 per cent in FY24, with

repo rate in the second half

one, which will normalize

Confidence 36 per cent of them expecting the biggest business concerns in of the current fiscal to let the going forward.

the current fiscal.

lagged impact of the rate

growth to come between 6.0-6.5

hikes effected so far to work

per cent, broadly in line with the

through the system. This

forecast of RBI and other

On inflation which has emerged

Index zooms multilateral agencies. The survey as a risk to growth, more than half implies that the survey

Expected GDP Growth in FY24

Expectations of Policy Rate in H2 FY24

to a >7.0�% <5.5�% 5.5�% to (% of Respondents)

(% of Respondents)

3%

Can't say

16%

15%

6.0%

three-quarter 16% RBI will start

cutting rates

11%

high in 6.5�% to 6.0�% to repo rate, but by a RBI will stick

with a pause

RBI will hike

7.0%

on repo rate

58%

29%

lower magnitude

6.5%

16%

36%

Q2 FY24 To tame the rising inflationary Improving domestic demand in the last two surveys too, was conducted during

impulses, the government in the

had expected their capacity

the participation of around

sentiments of the companies.

recent months has announced a the economy has bolstered the majority of the respondents September 2023 and saw

slew of supply-side measures. Two-third of the respondents utilisation to be in range of 200 firms of varying sizes

Notably, out of the key expect sales and new orders to 75-100 per cent, which is an and across all industry

measures imposed, one-third of increase in Q2FY24 by a higher encouraging sign as capacity sectors and regions of the

the survey respondents noted clip than in the previous quarter. utilisation needs to be country. Majority of the

T he robust macro results of the survey which that imposing export duties on Mirroring this, half of the maintained between 75-80 respondent firms were from

the manufacturing sector

per cent to fuel fresh

commodities will be the most

respondents (53 per cent) feel

fundamentals of the

established that nearly half of

Indian economy despite the the respondents (52 per cent) beneficial to tame inflationary that capacity utilisation in their investments in the economy. and notably, 54 per cent of

global headwinds got mirrored anticipate an improvement in pressures, followed by open company would range between overall firms belonged to

th

in an uptick of the CII Business rural demand in the first half market operations (26 per cent 75-100 per cent during Q2FY24. The 124 round of the CII the large & medium size

Confidence Index (CII-BCI) to of the current fiscal. of the respondents). It is heartening to note that in Business Outlook Survey cohort.

a three-quarter high of 67.1 in

the Jul-Sep quarter FY24 as The survey results highlighted Capacity Utilization (% of Respondents)

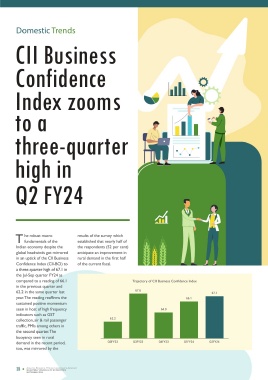

compared to a reading of 66.1 Trajectory of CII Business Confidence Index that about 55 per cent of the

in the previous quarter and respondents are of the view that 48 53

62.2 in the same quarter last 67.6 67.1 improving ease of doing

business along with

year. The reading reaffirms the 66.1 government’s thrust on capital 36 31

sustained positive momentum spending, especially in

seen in host of high frequency 64.0 infrastructure related sectors

indicators such as GST will help further crowd-in 11 12

collection, air & rail passenger 62.2 private investments. This will 4 5

traffic, PMIs among others in stimulate growth in other

the second quarter. The sectors of the economy through Below 50% 50-75% 75-100% Above 100%

buoyancy seen in rural its multiplier effect. Actual Q1 FY24 (Apr-Jun 2023) Expected Q2 FY24 (Jul-Sep 2023)

demand in the recent period, Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24

too, was mirrored by the

18 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 19

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

SEPTEMBER 2023 SEPTEMBER 2023