Page 21 - CII Artha Magazine

P. 21

Domestic Trends

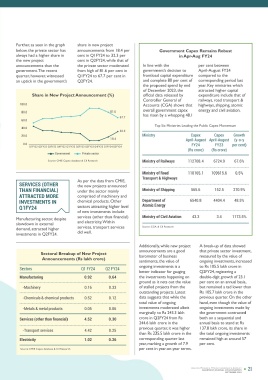

Investment Further, as seen in the graph share in new project Government Capex Remains Robust Completed Rs 1.47 lakh crore in the

previous quarter and Rs 1.39

below, the private sector has

announcements from 18.4 per

Investments

lakh crore in the comparable

cent in Q1FY24 to 32.3 per

always had a higher share in

in Apr-Aug FY24

quarter last year.

cent in Q2FY24, while that of

the new project

Trends announcements than the the private sector moderated In line with the per cent between The data suggests that the

April-August FY24

government’s decision to

from high of 81.6 per cent in

government. The recent

frontload capital expenditure compared to the

decline in value of completed

Q1FY24 to 67.7 per cent in

quarter, however, witnessed

and complete 80 per cent of

projects was driven by the

corresponding period last

Q2FY24.

an uptick in the government’s

the proposed spend by end

year. Key ministries which

private sector, while the value

of December 2023, the

Share in New Project Announcement (%)

official data released by

expenditure include that of

government recorded a

Controller General of attracted higher capital The value of completed of completed projects by the

railways, road transport &

double-digit growth as

projects slumped on both

100.0 Accounts (CGA) shows that highways, shipping, atomic sequential and annual basis compared to the previous

80.0 81.6 67.7 overall government capex energy and civil aviation. standing at Rs 1.0 lakh crore quarter.

has risen by a whopping 48.1

in Q2FY24 as compared to

I nvestments are crucial to signs that the private sector, 60.0 Top Six Ministries Leading the Public Capex Momentum

too, is working in tandem

sustain growth. The

government has been taking with the government to 40.0 32.3

the lead in pushing capex kickstart the investment cycle, 20.0 Ministry Capex Capex Growth

projects to bolster growth in which is essential for spurring 18.4 April-August April-August (y-o-y

the economy. There have been growth via its multiplier effect. 0.0 Q1FY22 Q2FY22 Q3FY22 Q4FY22 Q1FY23 Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 FY24 FY23 per cent)

(Rs crore) (Rs crore)

Government Private sector

Multiplier Effect of Capex on the Economy Source: CMIE Capex database & CII Research Ministry of Railways 112708.4 6724.9 67.6%

Increased Increased Increased Increased

Infrastructure CapEx Employment Consumption Capacity Ministry of Road 110165.1 109615.6 0.5%

Transport & Highways

(Rural+Urban) Demand Utilization As per the data from CMIE,

SERVICES (OTHER the new projects announced

THAN FINANCIAL) under the sector mainly Ministry of Shipping 565.6 152.5 270.9%

Help grow Economy PLI would help New Investment Opportunities ATTRACTED MORE comprised of machinery and Department of 6540.8 4404.4 48.5%

and Tackle Inflation supply side for Pvt sector INVESTMENTS IN chemical products. Other Atomic Energy

Q1FY24 sectors attracting higher level

of new investments include

Manufacturing sector, despite services (other than financial) Ministry of Civil Aviation 43.3 3.4 1173.5%

This section analyses in detail the recent trends in investment based on the CMIE Capex database, which would help assess the impact slowdown in external and electricity. Within

of recent initiatives being taken by both government and industry to facilitate investment revival. demand, attracted higher services, transport services Source: CGA & CII Research

investments in Q2FY24. did well.

New While high frequency there has been a noticeable unutilised capacity in some Additionally, while new project A break-up of data showed

improvement in the capacity

investment indicators

sectors might potentially be a

that private sector investment,

announcements are a good

Investments remained somewhat stable in utilisation of some sectors, contributing factor to the Sectoral Breakup of New Project barometer of business measured by the value of

Announcements (Rs lakh crore)

Q2FY24, the moderation in

decline in new investments.

especially in the

the pace of new investments manufacturing sector. The sentiments, the value of ongoing investments, increased

to Rs 105.5 lakh crore in

ongoing investments is a

NEW PROJECT might be seasonal as in the Sectors Q1 FY24 Q2 FY24 better indicator for gauging Q2FY24, registering a

ANNOUNCEMENTS past, the first half of most of Manufacturing 0.92 0.64 the investments happening on double-digit growth of 23.1

FALL STEEPLY IN the fiscal years has seen a Trends in New Project Announcements (Rs lakh crore) ground as it nets out the value per cent on an annual basis,

Q2FY24 slower uptick, with the 16.00 -Machinery 0.16 0.33 of stalled projects from the but remained a tad lower than

investment cycle picking up in

the latter part of the year. 14.00 13.44 outstanding projects. Latest Rs 105.7 lakh crore in the

New project announcements 12.00 -Chemicals & chemical products 0.52 0.12 data suggests that while the previous quarter. On the other

in the second quarter of the New investments in the 10.00 9.22 8.90 total value of ongoing hand, even though the value of

current fiscal (Q2FY24) private sector witnessed a 8.00 -Metals & metal products 0.05 0.06 investments moderated albeit ongoing investments made by

slumped both on a sequential significant moderation to Rs 6.00 6.43 6.56 5.25 12.19 6.56 marginally to Rs 243.3 lakh the government contracted

basis as well as on an annual 0.82 lakh crore in Q2FY24 4.40 4.27 4.52 4.63 8.11 Services (other than financial) 4.52 0.30 crore in Q2FY24 from Rs both on a sequential and

basis. The overall new project from Rs 5.35 lakh crore in the 4.00 2.40 2.78 2.96 3.84 5.35 244.6 lakh crore in the annual basis to stand at Rs

announcements in Q2FY24 fell previous quarter. The new 2.00 2.00 1.49 1.56 2.79 1.93 1.41 1.25 1.21 1.22 0.82 -Transport services 4.42 0.25 previous quarter, it was higher 137.8 lakh crore, its share in

0.79

by more than half to Rs 1.22 project announcements also 0.00 Q1FY22 Q2FY22 Q3FY22 Q4FY22 Q1FY23 Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 0.39 than Rs 225.5 lakh crore in the the total ongoing investments

lakh crore from Rs 6.56 lakh plummeted by 79 per cent on Electricity 1.02 0.26 corresponding quarter last remained high at around 57

crore in Q1FY24 and Rs 5.25 an annual year-on-year basis. Government Private sector Total investment year, marking a growth of 7.9 per cent.

lakh crore in the While the economic Source: CMIE Capex database & CII Research Source: CMIE Capex database & CII Research per cent in year-on-year terms.

corresponding period last year. landscape remains uncertain,

20 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 21

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

SEPTEMBER 2023 SEPTEMBER 2023