Page 24 - CII Artha Magazine

P. 24

State of States

was also mirrored in Q1FY24 higher PAT Margins during the

Interest Coverage Ratio (ICR) GDP print as these continued said quarter. The PAT Margin Analysing

8.0 to benefit from government’s for the oil & gas sector

7.0 7.2 sustained push towards received a boost from lower

infrastructure spending. The crude oil prices compared to

6.0 continued sluggishness in a year-ago period and no cut

5.0 5.9 external demand, however, in retail prices of petrol and Economic

4.0 impacted on the net sales of diesel. Also, earnings in the

3.0 the Textile sector. refining segment are likely to

2.0 have benefitted from the Performance

Q1FY21 Q2FY21 Q3FY21 Q4FY21 Q1FY22 Q2FY22 Q3FY22 Q4FY22 Q1FY23 Q2FY23 Q3FY23 Q4FY23 Q1FY24 Of the 15 sectors, availability of cheaper Russian

Pharmaceuticals, ITES, Power,

crude oil in Q1 FY24.

Consumer Durables saw

Note: includes analysis of 1910 non-financial listed companies

Source: CMIE Prowess Database and CII Research of Indian

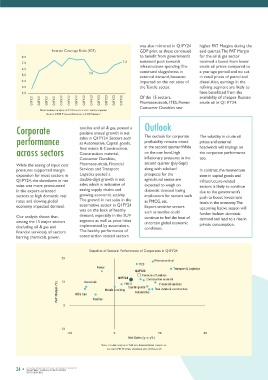

Corporate textiles and oil & gas, posted a Outlook

positive annual growth in net

performance sales in Q1FY24. Sectors such The outlook for corporate The volatility in crude oil States

profitability remains mixed

prices and external

as Automotive, Capital goods,

across sectors Real estate & Construction, in the second quarter. While headwinds will impinge on

the corporate performance

on the one hand, high

Construction material,

Consumer Durables, inflationary pressures in the too.

While the easing of input cost Pharmaceuticals, Financial second quarter (July-Sept)

pressures supported margin Services and Transport along with subdued In contrast, the momentum

expansion for most sectors in Logistics posted a prospects for the seen in capital goods and

Q1FY24, the slowdown in net double-digit growth in net agricultural sector are infrastructure-related ndia stands as the world's and surpassing pre-pandemic potential to catch up with the GDP. In the northern region,

sales was more pronounced sales which is indicative of expected to weigh on sectors is likely to continue I fastest-growing major levels. high-performing states in the states like Punjab, Haryana, and

in the export-oriented easing supply chains and domestic demand having due to the government’s economy and is well poised to years to come, given their Rajasthan make significant

sectors as high domestic real growing economic activity. implications for sectors such push to boost investment reach US$9 trillion milestone States like Gujarat, current trajectory. contributions, accounting for

rates and slowing global The growth in net sales in the as FMCG, etc. levels in the economy. The by 2030. States hold the key to Maharashtra, Tamil Nadu, and 18.5 per cent of the GDP.

economy impacted demand. automotive sector in Q1FY24 Export-sensitive sectors upcoming festive season will achieving this vision, as they Karnataka are the economic Regionally, the Southern region Eastern states, represented by

was on the back of healthy such as textiles could drive India’s economic growth powerhouses, driving the stands out as the most West Bengal, Odisha, and Bihar,

Our analysis shows that, demand, especially in the SUV continue to feel the heat of further bolster domestic and development trajectory. nation’s GDP by contributing significant contributor to contribute 12.5 per cent and

demand and lead to a rise in

among the 15 major sectors segment as well as price hikes uncertain global economic private consumption. However, regional disparities to nearly half of the nation’s India’s GDP, with states like Central region, including Uttar

(including oil & gas and implemented by automakers. conditions. loom large in India’s economic economic output and Andhra Pradesh, Karnataka, Pradesh and Madhya Pradesh,

financial services), all sectors The healthy performance of performance, stemming from outperforming national GDP Kerala, Tamil Nadu, and contribute 13.6 per cent to the

barring chemicals, power, construction related sectors diverse geography and varying growth. These are large and Telangana contributing around nation’s output. The Northeast

state-level economic growth. diversified economies with a 30 per cent to the nation’s region, comprising states like

Five states – Maharashtra, well-established manufacturing economic output. The western Assam, Manipur, Meghalaya, and

Snapshot of Sectoral Performance of Corporates in Q1FY24

Gujarat, Tamil Nadu, Karnataka base and a robust services region, anchored by Gujarat others, has a relatively modest

20 and Uttar Pradesh are the sector. Rajasthan, Uttar and Maharashtra, contributes economic share, standing at

Pharmaceutical

ITES major contributors to India’s Pradesh, West Bengal and roughly 23 per cent to India’s just 2.7 per cent.

Power Transport & Logistics GDP, with a collective GSDP Chhattisgarh are emerging as

Q4FY23

Consumer Durables of about Rs 75 lakh crore high-potential states, displaying

Q1FY24 representing a substantial 47 robust GSDP growth rates

10 Chemicals FMCG Construction material per cent share in India’s GDP. that surpass the national Regional Contribution to India’s GDP (%)

PAT Margin (%) Oil & Gas Metals & mining Capital goods Real estate & construction India’s GDP for the fiscal year average in the post-pandemic 18.5

Financial services

Automotive

period. These states have

contribution of nearly 20 per

lakh crore (at constant prices),

0 Textiles 2022-23 has reached Rs 160 collectively made substantial 30.0 2.7

Further, higher profits also average rate of 4.43 per cent improved to 7.2 from 5.9 a surpassing its pre-pandemic cent to the nation’s GDP.

helped the companies sustain in the first quarter of the year ago, thereby reflecting five-year average of Rs 130 Smaller states such as Assam, 12.5

their debt servicing capability previous fiscal. The interest stronger financial health of lakh crore spanning from 2015 Tripura, Manipur and

despite higher interest rates. coverage ratio, which is a the corporates. Robust -10 to 2020. Majority of the states Arunachal Pradesh are poised 22.7 13.6

During the first quarter, RBI ratio of the company’s balance sheets of the private -20 0 20 40 have shown a remarkable to become new frontiers,

kept its key policy repo rate earnings before interest and sector and banks, too, confirm Net Sales (y-o-y%) recovery from the challenges demonstrating significant

unchanged at 6.5 per cent, taxes over its interest this trend. Note: includes analysis of 524 non-financial listed companies posed by the Covid-19 progress in growth. They have North North East East Central West South

which is much higher than the expense during the period, Source: CMIE Prowess Database and CII Research pandemic with their GSDP recently registered rapid Source: MoSPI

witnessing significant growth growth rates and hold the

24 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 25

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

SEPTEMBER 2023 SEPTEMBER 2023