Page 29 - CII Artha Magazine

P. 29

Amongst the other major Europe came at 3.5 per cent 2022 to one of its worst in drive recovery in demand for The British households 10.4 per cent in the previous by the trend in inflation, US Fed, in its May monetary basis points, pressing ahead Credit Suisse was taken over by such as Japan and China are

economies, global slowdown in 2022. Surging oil and gas nearly half a century. After foreign services; boost continue to contend with high month. The main upward monetary policy as well as CENTRAL BANKS policy raised interest rates by with its campaign to tame Switzerland’s largest bank UBS. keeping their monetary policies

has been hitting the prices have depleted savings slowing to 2.9 per cent in Q4 commodity demand and food and energy bills, while pressure came from food, geopolitical stability, has come REMAIN HAWKISH AS 25 basis points to 5.25%, which inflation despite the threat of loose to bolster economic

economies unevenly. UK and have held back 2022, the growth for whole of prices, particularly for oil. workers across sectors have recreation and cultural off its recent peak and is THEY AGGRESSIVELY is the highest since June 2006. It potential banking crisis after On the contrary, economies growth.

economy showed near zero investment, while forcing the 2022 came at just 3.0 per cent. launched mass strike amid activities. witnessing a downtrend. HIKE INTEREST has hinted at a potential pause

RATES TO CONTROL

growth (0.4 per cent) in Q4 European Central Bank into The contraction in real estate, disputes over pay conditions. Noteworthily, the US Dollar Latest data suggests that US INFLATION in further increases as the

financial markets have been

Dollar Index stood at 101.0

UK's inflation print eased to

2022, avoiding a recession for unprecedented rate hikes to uncertainty around evolution GLOBAL INFLATION 10.1 per cent in March from index, which is widely affected as on 13th April 2023. impacted by the collapse of the

now even as it continues to arrest inflation. of the virus, shrinking EXHIBITING SOME two banks.

wrestle with double-digit population and slowing SOFTENING FROM The tight global financial

inflation. Industrial disputes, Japan, too, narrowly averted a productivity growth remain a ELEVATED LEVELS markets due to the near Further, as inflation in UK

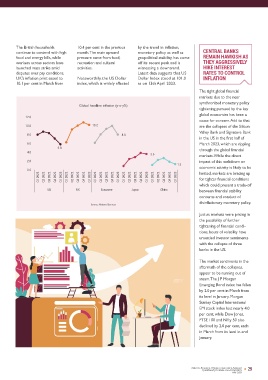

staff shortages, export losses, recession by growing 0.4 per major headwind. However, Global headline inflation (y-o-y%) synchronized monetary policy accelerated in February, Bank of

rising cost of living and higher cent in Q4 2022. The with an earlier than tightening pursued by the key England too boosted its key

interest rates, all dragged deceleration reported was on anticipated re-opening of 12.0 global economies has been a rate by 25 basis points to 4.25

down the growth of UK to account of a contraction in the China, IMF expects it to Inflation, which emerged as a 10.2 cause for concern. Add to that per cent. This hike was the

4.2 per cent in 2022 from 8.5 corporate capital investment contribute about a third of big risk post the Russia’s 10.0 are the collapses of the Silicon smallest rate hike since May last

per cent in 2021. as well as the private housing global growth in 2023. China's invasion of Ukraine last year 8.0 8.0 Valley Bank and Signature Bank year. The bank also highlighted

investment levels. For the growth in Q12023 advanced has started exhibiting some in the US in the first half of that in case inflationary

As for Europe, its economy is whole of 2022, the Japanese to 4.5 per cent, amid efforts softening from the elevated 6.0 5.8 March 2023, which are rippling pressures persists, further

bearing the brunt as Russia’s economy posted a growth of from the government to spur levels, prompting central banks 4.0 3.6 through the global financial tightening in monetary policy

war in Ukraine hit both 1.0 per cent as compared to the post-pandemic recovery. across the globe to moderate markets. While the direct would be required.

business activity and drive-up 2.2 per cent recorded last the size and pace of rate hikes. 2.0 1.3 impact of this meltdown on

energy prices. Europe year. Rising fuel costs after The re-opening of China is IMF expects the global 0.0 economic activity is likely to be The European Central Bank, in

economy eked out growth in Russia’s invasion of Ukraine, likely to boost global inflation to fall from 8.7 per Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 limited, markets are bracing up its seventh consecutive rate

Q4 2022 even as sky-high yen’s depreciation and a drag economic growth faster than cent in 2022 to 7.0 per cent in for tighter financial conditions hike, raised interest rates by 25

energy costs, waning down in net exports impacted expected, through ‘three direct 2023 and to 4.9 per cent in which could present a trade-off

confidence and rising interest the growth in 2022. channels’, viz increased 2024. US UK Eurozone Japan China between financial stability

rates took a toll on the domestic demand, which will concerns and conduct of

economy. However, its growth The Chinese economy was lift core good exports among The pace of consumer price Source: National Sources disinflationary monetary policy.

at 1.8 per cent in Q4 2022 also seen slowing due to China’s trade partners; increase eased in a few

was the slowest in the year. stringent covid curbs, which international travel, which will countries like US, Europe, Just as markets were pricing in

The full year growth for dragged out the growth for Japan and China but are still the possibility of further

far from the tolerance range tightening of financial condi-

of the central banks. Despite tions, bouts of volatility have

the moderation of inflation unsettled investor sentiments

Trajectory of Real GDP growth (y-o-y%) from its peak, the core with the collapse of three

12.0 inflation, which removes food banks in the US.

and fuel prices remains

10.0 The market sentiments in the

elevated, which is a cause for

8.0 concern. aftermath of the collapses,

appear to be running out of

6.0 The global commodity prices steam. The J P Morgan

4.5 have been on a downward Emerging Bond index has fallen

4.0 by 2.0 per cent in March from

trend amid the slowing

2.0 demand globally and a healthy its level in January. Morgan

1.6 1.3 0.4 supply outlook. However, the Stanley Capital International

0.0 0.4 recent announcement by EM stock index lost nearly 4.0

per cent, while Dow Jones,

Q12022 Q22022 Q32022 Q42022 Q12023 Q12022 Q22022 Q32022 Q42022 Q12023 Q12022 Q22022 Q32022 Q42022 Q12022 Q22022 Q32022 Q42022 Q12022 Q22022 Q32022 Q42022 Q12023 OPEC+ to cut oil production FTSE 100 and Nifty 50 also

by 1.16 million barrels a day

US Eurozone UK Japan China could push the prices higher, declined by 2.0 per cent, each

thereby leading to higher in March from its level in end

Source: National Sources import bills for certain January.

nations.

28 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 29

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

MAY 2023 MAY 2023