Page 30 - CII Artha Magazine

P. 30

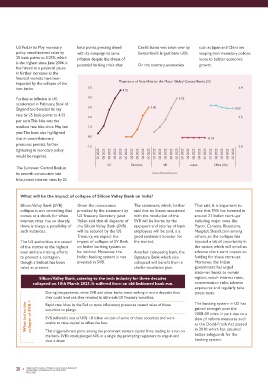

US Fed, in its May monetary basis points, pressing ahead Credit Suisse was taken over by such as Japan and China are

policy raised interest rates by with its campaign to tame Switzerland’s largest bank UBS. keeping their monetary policies GLOBAL TRADE Export growth across major economies (% y-o-y)

25 basis points to 5.25%, which inflation despite the threat of loose to bolster economic TO SLOW ON 40.0 40

is the highest since June 2006. It potential banking crisis after On the contrary, economies growth. RECESSIONARY

has hinted at a potential pause

in further increases as the FEARS

financial markets have been 20.0 20

impacted by the collapse of the Trajectory of Rate Hike by the Major Global Central Banks (%)

two banks. 5.0 4.0 Greater risks are building up in

The tight global financial 4.75 the international environment

markets due to the near Further, as inflation in UK 4.0 3.92 for trade, financial and 0.0 8.4 9.1 0

synchronized monetary policy accelerated in February, Bank of technology flows. World trade 3.1

tightening pursued by the key England too boosted its key 3.0 3.00 3.65 is getting fragmented by -4.6 -6.8

global economies has been a rate by 25 basis points to 4.25 2.0 3.5 forceful moves towards

cause for concern. Add to that per cent. This hike was the protectionism or -20.0 -20

are the collapses of the Silicon smallest rate hike since May last 1.0 friend-shoring, with each Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022

country seeking control over

Valley Bank and Signature Bank year. The bank also highlighted the production of strategic

in the US in the first half of that in case inflationary 0.0 -0.10 materials and industries US Eurozone UK (rhs) Japan (rhs) China

March 2023, which are rippling pressures persists, further -1.0 3.0 through subsidies and other Source: National Sources

through the global financial tightening in monetary policy incentives.

markets. While the direct would be required. Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023

impact of this meltdown on Globally, exports have started 1.0 per cent in 2023 from 3.5 slowdown as fears of a global Outlook

economic activity is likely to be The European Central Bank, in US Eurozone UK Japan China (rhs) to lose momentum as the per cent last year, as all recession dampen export

global economy has sustained

limited, markets are bracing up its seventh consecutive rate Source: National Sources multiple shocks such as ripple indicators point towards a demand of the major The global outlook remains

for tighter financial conditions hike, raised interest rates by 25 effects from the war in Ukraine downside. economies. In US, the export highly uncertain amidst the

growth has decelerated sharply

which could present a trade-off and its resultant food and IMF too, has warned that global to 8.4 per cent in Q4 2022 lingering war in Ukraine,

between financial stability energy crisis. The import flow of goods is levelling off. It from 22.7 per cent in the high level of inflation and

concerns and conduct of What will be the impact of collapse of Silicon Valley Bank on India? demand too has started to expects the trade volume of previous quarter. A sharp drop aggressive monetary

disinflationary monetary policy. soften due to slowdown in goods and services to slow was witnessed in the export tightening undertaken by the

Silicon Valley Bank (SVB) Given the reassurance The statement, which, further That said, it is important to growth in the major from 4.3 per cent in 2022 to growth for UK and Europe, central banks to tackle

collapse is not something that provided by the statement by said that no losses associated note that SVB has invested in economies. World Trade inflation. The above stated

Just as markets were pricing in comes as a shock, for when US Treasury Secretary Janet with the resolution of the around 21 Indian start-ups Organisation (WTO) in its 2.5 per cent in 2023. while that for Japan and China

the possibility of further interest rates rise so sharply, Yellen said that all deposits of SVB will be borne by the including major ones like latest report, expects the The latest data available for Q4 showed a contraction in Q4 reasons are likely to dampen

the growth prospects of

2022.

tightening of financial condi- there is always a possibility of the Silicon Valley Bank (SVB) taxpayers and salaries of bank Paytm, Carwale, Bluestone, merchandise trade to slow to 2022 points towards a economies across

tions, bouts of volatility have such instances. will be secured by the US employees will be paid, is a Naaptol, Shaadi.com among geographies in the current

unsettled investor sentiments Treasury, we expect the good sentiment booster for others, so the collapse has year. However, there are

with the collapse of three The US authorities are seized impact of collapse of SV Bank the market. injected a bit of uncertainty in signs of growth recovering in

banks in the US. of the matter at the highest on Indian banking system to the sector, which will entail an many of the developed

level and are making efforts be minimal. Moreover, the Another competing bank, the adverse short-term impact on economies, with India and

to prevent a contagion, Indian banking system is not Signature Bank which also funding for these start-ups. China further contributing a

The market sentiments in the though a bailout has been invested in SVB. collapsed will benefit from a Moreover, the Indian major chunk to the world

aftermath of the collapses, ruled at present. similar resolution plan. government has urged growth. Moreover, as

appear to be running out of state-run banks to remain inflation trajectory is on a

steam. The J P Morgan Silicon Valley Bank, catering to the tech industry for three decades vigilant, watch interest rates, downward trend, we can

Emerging Bond index has fallen collapsed on 10th March 2023. It suffered from an old-fashioned bank run. concentration risks, adverse expect central banks across

by 2.0 per cent in March from During the pandemic, when SVB and other banks were ranking in more deposits than exposures and regularly take the world to lower the pace

stress tests.

its level in January. Morgan they could lend out, they invested in ultra-safe US Treasury securities. of interest rate hikes going

Stanley Capital International Rapid rate hikes by the Fed to tame inflationary pressures caused value of these The banking system in US has forward, which would

further propel demand.

EM stock index lost nearly 4.0 securities to plunge. gained strength post the

per cent, while Dow Jones, collapse of SVB ? 2008-09 crisis in part due to a

FTSE 100 and Nifty 50 also What led to the SVB suffered a loss of US$ 1.8 billion on sale of some of these securities and were slew pf reform measures such

declined by 2.0 per cent, each unable to raise capital to offset the loss. as the Dodd-Frank Act passed

in March from its level in end This triggered mass panic among the prominent venture capital firms, leading to a run on in 2010 which has ensured

better safeguards for the

January. the bank. SVB’s stock plunged 60% in a single day, prompting regulators to step in and banking system.

shut it down.

30 ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY ANALYSIS, RESEARCH, THOUGHT LEADERSHIP & ADVOCACY 31

QUARTERLY JOURNAL OF ECONOMICS

QUARTERLY JOURNAL OF ECONOMICS

MAY 2023 MAY 2023